Canada Gazette, Part I, Volume 157, Number 33: Clean Electricity Regulations

August 19, 2023

Statutory authority

Canadian Environmental Protection Act, 1999

Sponsoring departments

Department of the Environment

Department of Health

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Executive summary

Issues: There is an urgent need to address climate change and Canada is committed to do its part. As climate change makes weather patterns more extreme and volatile, weather-related disasters (e.g. floods, storms and wildfires) are becoming more frequent and costlier. Insured losses as a result of catastrophic weather events in Canada totalled over $18 billion (2019 $CAD) between 2010 and 2019, while the number of catastrophic weather events in this period was over three times higher than it had been between 1980 and 1989.footnote 1 Without rapid mitigation to reduce greenhouse gas (GHG) emissions to keep the global temperature increase below 1.5 °C (degrees Celsius) relative to pre-industrial levels, the adverse impacts of climate change are projected to escalate beyond adaptive capacity (the ability of social-ecological systems to adapt to environmental change)footnote 2, affecting disproportionally the most vulnerable of our population. In addition to causing catastrophic environmental and human health impacts, climate change will also entail significant social, cultural and economic losses in Canada. In an effort to help limit the worst of these impacts and based on the overwhelming conclusion of climate science, in 2021, Canada joined over 120 countries in committing to be a net-zerofootnote 3 GHG emissions economy by 2050.

In order to achieve net-zero GHG emissions economy-wide by 2050, the electrification of energy-intensive activities, such as transportation, heating and cooling of buildings and various industrial processes, will be needed. For that electrification to have the desired impact, electricity generation will need to come from low and non-emitting electricity generation sources (see Table 3 for a description of these technologies) and this will need to happen much earlier than 2050. Considering, for example, that the Government of Canada (the Government) has proposed a sales mandate to ensure that 100% of light-duty vehicles sales would be zero GHG emissions vehicles by 2035,footnote 4 the Government has determined that without federal regulations to ensure the electricity-generating sector is prepared to supply cleaner electricity from low and non-emitting electricity generating sources by 2035, the sector would not be on a path that would enable the economy to reach net-zero GHG emissions by 2050.

Description: The proposed Clean Electricity Regulations (the proposed Regulations) would establish performance standards to reduce GHG emissions from fossil fuel–generated electricity starting in 2035.

Rationale: The proposed Regulations would accelerate progress towards a net-zero electricity-generating sector, helping Canada become a net-zero GHG emissions economy by 2050. These efforts are needed to help limit the worst impacts of climate change. The proposed Regulations would set performance standards that would ensure that the sector achieves significant transformation by 2035, so that a robust foundation of clean electricity is available to power the electric technologies (e.g. electric transportation) needed to support Canada’s transition to a net-zero GHG emissions economy by 2050.

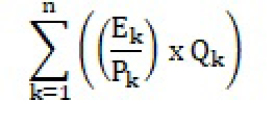

A cost-benefit analysis (CBA) was conducted using outputs from two departmental models, NextGrid and E3MC, in a manner that seeks to minimize the system-wide (national) cost of meeting electricity demand subject to many constraints including policy parameters, system reliability and resource availability (e.g. geological constraints). The CBA acknowledges a variety of external economic and environmental changes that may occur over the analytical period by using conservative assumptions where appropriate and by testing alternative parameters in sensitivity analysis. The CBA represents central case modelling in which electricity demand increases by 40% over the analytical period. This central case scenario does not represent the only path that the electricity-generating sector could take to comply with the regulatory requirements, which will ultimately depend on investment decisions taken at the provincial level. Based on the set of assumptions used within the central case modelling, the CBA estimates that the proposed Regulations would result in a net reduction of 342 million metric tonnes (Mt) of carbon dioxide equivalent units (CO2e) of GHG emissions between 2024 and 2050 (the 27-year analytical period). The incremental benefit associated with these GHG reductions, alongside cost savings to the electricity system, is estimated to be $102.5 billion, while the incremental cost is estimated to be $73.6 billion over the 27-year analytical period, thereby resulting in a net benefit to society of $28.9 billion (2022 constant dollars, discounted to base year 2023 at a 2% discount rate).

Issues

There is an urgent global need to address climate change and Canada is committed to do its part. Climate change is responsible for significant extreme weather, food supply disruptions and increased wildfires worldwide. Over the past five decades in Canada, the annual costs of weather-related disasters like floods, storms and wildfires have risen from tens of millions of dollars to billions of dollars. From 2010 to 2019, the number of catastrophic events was over three times higher than during the 1980s. Weather-related disaster damages are among the most visible indicators of the costs of climate change; yet these costs provide an incomplete picture since they do not represent the full range of social (e.g. human health impacts), economic and environmental damages of climate change.footnote 5 The world has already warmed by about 1.0 °C (degrees Celsius) above pre-industrial levels (1850-1900) due to human activities and is experiencing the related negative impacts. At the current rate of warming of 0.2 °C per decade, global warming will reach 1.5 °C between 2030 and 2052.footnote 6 Without rapid mitigation to reduce GHG emissions to limit global warming to 1.5 °C, the adverse impacts of climate change are projected to escalate beyond adaptive capacity, affecting the most vulnerable members of our society disproportionally. In 2021, Canada joined over 120 countries in committing to a net-zero GHG emissions economy by 2050footnote 7 to help limit global warming to 1.5 °C and avoid the worst impacts of climate change.

In order to achieve net-zero GHG emissions economy-wide by 2050, the electrification of energy-intensive activities, such as transportation,footnote 8 heating and cooling of buildings, as well as various industrial processes, will be needed. Even in the absence of regulatory action to control electricity sector emissions of carbon dioxide, this needed electrification will require significant investment to maintain, upgrade and expand Canada’s fleets of electricity generators. Preliminary estimates by the Department indicate that such investments are likely to be more than $400 billion. If electrification is to have the required GHG reduction impact, then the investments will need to be directed to low and non-emitting electricity generation sources (see Table 3 for a description of these technologies) and this will need to happen much earlier than 2050. Without federal regulations to ensure the electricity-generating sector is prepared to supply cleaner electricity from low and non-emitting electricity generating sources by 2035, the sector would not be on a path that would enable the economy to reach net-zero GHG emissions by 2050.

Background

Urgent need to address climate change and Canada’s climate change commitments

Reducing global GHG emissions to net-zero by 2050 provides the best chance to limit severe climate change related risks due to global warming. GHGs are a natural part of the Earth’s geological systems; however, human activities such as the burning of fossil fuels are rapidly increasing levels of atmospheric GHGs. This increased concentration of GHGs in the atmosphere increases the temperature on Earth’s surface (global warming), thus causing climate change. With increasing global surface temperatures, the probability of more droughts and increased intensity of storms will occur. As more water is evaporated into the atmosphere, it fuels increasingly powerful storms. More heat in the atmosphere and warmer ocean surface temperatures can lead to increased wind speeds in tropical storms. Rising sea levels expose higher locations not previously subject to the power and destructive capacity of oceans, including the erosive forces of waves and currents. The Earth has already warmed by about 1.0 °C above pre-industrial levels due to human activities and is experiencing the consequential impacts. In 2022, the Intergovernmental Panel on Climate Change (IPCC) released the report Climate Change 2022: Impacts, Adaptation, and Vulnerability (PDF) that assessed that climate change, including increases in the frequency and intensity of climate and weather extremes, has caused widespread adverse impacts on ecosystems, agriculture, food, water, human health, livelihoods and economic activity. By disproportionately affecting the most vulnerable, especially through impacts on food, water and livelihoods, climate change can further exacerbate existing inequalities and inequities, both domestically and worldwide. The Canadian Disaster Database (CDD) tracks the most significant weather-related hazards, in terms of frequency, cost and displaced people. The CDD estimates that natural disaster costs totalled $35 billion (2019 $CAD) for 300 of the 645 weather-related disasters recorded since 1970. Floods were the most frequently reported weather-related disasters (40% of the total number of disasters), followed by severe thunderstorms (18%), wildfires (15%) and winter storms (9%). Hail, wind and ice events are included in these categories. The annual number of disasters in the CDD has steadily increased since the 1970s, fluctuating between a low of 8 in the early 1970s to a high of 27 per year in 2016. In addition to an increase in the number of disasters, the cost per disaster has also increased — rising from an average of $8.3 million (2019 $CAD) per event in the 1970s to an average $112 million (2019 $CAD) per event in the 2010s. This change represents a 1 250% increase over four and a half decades.footnote 1

At the current rate of warming of 0.2 °C per decade, global warming will reach 1.5 °C between 2030 and 2052. Considering the impacts of climate change associated with global warming already reaching 1.0 °C above pre-industrial levels, near-term increases in global warming reaching 1.5 °C would cause unavoidable increases in multiple hazards and present risks to ecosystems and humans beyond adaptive capacity. Near-term actions that would limit global warming close to 1.5 °C would substantially reduce future risks compared to those at higher warming levels. The effects of widespread climate change are already evident in many parts of Canada and are projected to intensify in the future. In addition to significant environmental loss, including accelerated habitat and species loss, this will have a negative impact on the social (e.g. human health impacts), cultural and economic life of Canada and its people.

According to the International Energy Agency,footnote 9 global annual GHG emissions have increased 60% from 21.4 gigatonnes (Gt)footnote 10 in 1990 to 34.2 Gt in 2020. Over the same period, Canada’s emissionsfootnote 11 increased 13% from 595 megatonnes (Mt) to 672 Mt. Although Canada’s contribution to global totals may seem relatively small, per capita Canada ranks as the 7th highest GHG emitter globally.footnote 12

Canada has been active in seeking to reduce GHG emissions both internationally and nationally

Internationally

- In 2015, Canada and 194 other countries concluded negotiations on the Paris Agreement; in the Agreement, Canada set a goal to reduce its GHG emissions by 30% below 2005 levels by 2030, which Canada amended in 2021 to set a 2030 goal of reducing GHG emissions by 40–45% below 2005 levels.

- In 2021, Canada joined over 120 countries by committing to be a net-zero GHG emissions economy by 2050.

- On May 11, 2023, the United States Environmental Protection Agency published the Greenhouse Gas Standards and Guidelines for Fossil Fuel-Fired Power Plants.

Nationally

- In 2016, the Pan-Canadian Framework on Clean Growth and Climate Change (PCF): Canada’s plan to address climate change and grow the economy (PDF) was published and included more than 50 measures to drive down Canada’s GHG emissions, help build resilience across the country and support climate innovation for clean economic growth. The PCF was developed in collaboration with Canada’s provinces and territories and in consultation with national Indigenous organizations, interested parties and Canadians.

- The federal Greenhouse Gas Pollution Pricing Act (GGPPA) came into force on June 21, 2018. The GGPPA establishes the framework for the federal backstop carbon pollution pricing system (putting a price on GHGs), which consists of two parts: a regulatory charge on fossil fuels like gasoline and natural gas, the fuel charge under Part 1 of the GGPPA and regulatory trading system for industry known as the Output-Based Pricing System (OBPS), under Part 2 of the GGPPA. The OBPS is designed to put a price on carbon pollution, creating an incentive for industrial facilities from sectors at significant risk of carbon leakage and competitiveness impacts to reduce their GHG emissions per unit of output. Under the Government of Canada’s approach to pricing carbon pollution, provinces and territories have the flexibility to implement a carbon pricing system that makes sense for their circumstances, provided that the system meets the minimum national stringency criteria (the federal benchmark). Since 2019, every jurisdiction in Canada has had a price on carbon pollution.

- In 2020, the Healthy Environment and a Healthy Economy: Canada’s strengthened climate plan to create jobs and support people, communities and the planet was published. It builds on the PCF and included 64 strengthened and new federal policies, programs and investments to cut carbon pollution and build a stronger, cleaner and more resilient and inclusive economy.

- In 2021, the Canadian Net-Zero Emissions Accountability Act (CNZEAA) was enacted. The CNZEAA formalizes Canada’s target to achieve net-zero GHG emissions economy-wide by 2050. It establishes a series of interim GHG emissions reduction targets at five-year milestones and requires a series of plans and reports to help Canada achieve its milestones on the way towards that goal. Pursuant to the CNZEAA, the Net-Zero Advisory Body (NZAB) was established with the mandate to provide independent advice with respect to achieving Canada’s target of net-zero GHG emissions economy-wide by 2050.footnote 13

- In March 2022, Canada’s 2030 Emissions Reduction Plan (2030 ERP): Canada’s next steps for clean air and a strong economy (PDF) was published. The 2030 ERP includes key measures the Government of Canada intends to take in order to achieve the 2030 target (40–45% GHG emission reductions below 2005 levels), an interim GHG emissions objective for 2026, an overview of relevant sectoral strategies and a projected timetable for implementation of these measures. The 2030 ERP provides a roadmap toward achieving net-zero GHG emissions economy-wide by 2050.

Canada’s climate change strategy for electricity generation

According to Canada’s 2022 National Inventory Report (2022 NIR)footnote 14, Part 3, in 2020, Canada generated 575,000 Gigawatt hours (GWh)footnote 15 of electricity and emitted 62 Mt of carbon dioxide (CO2) equivalent, abbreviated as CO2efootnote 16 (9.2% of total national GHG emissions). Of the electricity generated that year, 16% came from emitting electricity sources that use fossil fuels (e.g. coal, natural gas, other fuels such as refined petroleum products) while 84% were from low and non-emitting electricity sources that use renewable fuels (e.g. nuclear and renewables, such as hydro, wind and solar) to power generation. Table 1 provides a breakdown of electricity generation by emitting and low and non-emitting electricity sources and CO2e emissions by region in 2020.

| Region | Electricity generation (GWh) | % of generation from low- and non- emitting electricity sources | % of generation from emitting sources | CO2e emissions (kt) from emitting electricity generation |

|---|---|---|---|---|

| NL | 39,800 | 97% | 3% | 950 |

| PE | 660 | 100% | 0% | 0.3 |

| NS | 9,420 | 21% | 79% | 6,340 |

| NB | 12,000 | 70% | 30% | 3,470 |

| QC | 188,000 | 99% | 1% | 290 |

| ON | 149,000 | 94% | 6% | 3,710 |

| MB | 37,200 | 100% | 0% | 28 |

| SK | 24,000 | 22% | 78% | 13,900 |

| AB | 55,800 | 15% | 85% | 32,700 |

| BC | 58,400 | 97% | 3% | 420 |

| YK | 530 | 83% | 17% | 54 |

| NT | 350 | 74% | 26% | 62 |

| NU | 200 | 0% | 100% | 150 |

| Canada | 575,000 | 84% | 16% | 62,100 |

The 2022 NIR shows that GHG emissions from the emitting electricity-generating sector have been cut by more than half from 132 Mt of CO2e in the year 2000 to 62 Mt of CO2e in 2020, while electricity generation, which was 539,000 GWh in 2000, did not fluctuate significantly. Table 2 provides a breakdown by emitting and low- and non-emitting electricity generation sources in 2000 and 2020 in Canada.

| Electricity generation (GWh) by fuel | Coal | Natural gas | Other fuels | Nuclear | Hydro | Other renewables | Total electricity generation (GWh) | CO2e emissions (kt) from emitting electricity generation |

|---|---|---|---|---|---|---|---|---|

| 2000 | 106,440 | 26,616 | 13,250 | 68,650 | 323,130 | 260 | 538,346 | 132,044 |

| % of total electricity generation | 20% | 5% | 2% | 13% | 60% | 0.05% | 100% | - |

| 2020 | 35,940 | 47,978 | 7,346 | 92,590 | 354,980 | 36,180 | 575,013 | 62,197 |

| % of total electricity generation | 6% | 8% | 1% | 16% | 62% | 6% | 100% | - |

Table 2 shows that the GHG emission reductions from 2000 to 2020 were mostly driven by a significant decrease in the use of coal as a fuel to generate electricity (from 20% in 2000 to 6% in 2020) and adoption of low and non-emitting electricity generation sources (from 73% in 2000 to 84% in 2020).

Federal actions (regulatory and non-regulatory) to support the reduction of GHG emissions from the emitting electricity-generating sector

Canada continues to be active in seeking GHG emission reductions from the electricity-generating sector, this includes federal regulatory and non-regulatory actions including

Regulatory actions

- The Canadian Environmental Protection Act, 1999 (CEPA, or the Act) aims to prevent pollution and protect the environment and human health. The Act sets out rules for preventing and regulating toxic substances, including GHG substances (e.g. carbon dioxide and methane) and provides the authority for the Governor in Council (GIC) to make regulations to manage pollution in Canada. Regulatory authorities under both CEPA and the GGPPA have been used to reduce GHG emissions from the electricity sector.

- In 2012, the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations were published for the purpose of establishing a regulatory regime to reduce CO2 emissions resulting from conventional coal-fired electricity generation.

- In 2018, the Regulations Amending the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations were published to accelerate the reduction of CO2 emissions from conventional coal-fired electricity generation by 2030 to help Canada meets its GHG emissions reduction commitment under the Paris Agreement.

- In 2018, the Government published the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricity to limit CO2 emissions from the use of natural gas as a fuel to generate electricity in Canada.

- Since 2019, the federal backstop carbon pollution pricing system has been in place in jurisdictions that requested it, or that did not have a system that meets the federal national minimum stringency criteria (the federal benchmark). Carbon Pricing is applied to industrial sectors, including the electricity sector through the federal output-based pricing system (OBPS) or an applicable provincial carbon pricing system.footnote 17 These systems, including the OBPS, are designed to ensure there is a price incentive for companies to reduce their GHG emissions and spur innovation while maintaining competitiveness and protecting against carbon leakage. Under the OBPS, industrial facilities face a carbon price on the portion of their GHG emissions that are above their facility emission limit, which is determined based on relevant output-based standards (OBS). As of 2030, electricity generation capacity from gaseous fuel that meets specified criteria and that was put in place on or after January 1, 2021, whether at an existing or new facility, would be fully exposed to the carbon price. Any such electricity generation capacity that existed prior to 2021 would be subject to the carbon price only for the portion of GHG emissions above the OBS of 370 t /GWh.

Non-regulatory actions

- Since 2016, the Government of Canada has directed over $50 billion in targeted investments towards building net-zero electricity systems in Canada. This includes programs such as the Smart Renewables Electrification Pathways Program (SREP), a $1.57 billion program, including $600 million announced in Budget 2022, which provides support for smart renewable energy and electrical grid modernization projects, including projects that support capacity building. Since December 2021 to February 2023, the SREP provided funding for about $164.5 million.footnote 18 In Budget 2023, the Government of Canada announced an increase in funding of $3 billion for the SREP.

- The Government of Canada provides low-interest financing to clean electricity projects through a variety of mechanisms, including investments and financing from the Canada Infrastructure Bank (CIB) and Strategic Innovation Fund, as well as federal tax incentives. These initiatives total more than $20 billion. This includes:

- The Canada Growth Fund ($15 billion to fund investments in support of a net-zero GHG emissions economy); and

- Budget 2023 announced a new investment target for the Canada Infrastructure Bank of at least $10 billion through the Clean Power priority area for building of major clean electricity.

Despite these actions and the fact that in 2020, only 16% of the electricity generated in Canada came from emitting electricity sources, analysis shows that Canada’s emitting electricity-generating sector is not on a path to achieve significant emissions transformation by 2035. For Canada to meet its economy-wide, net-zero emissions target by 2050, significant growth in clean electricity supply is needed. There is a broad consensus among researchers that the increased use of electric technologies (e.g. electric transportation, heating and cooling of buildings and solutions for various industrial processes) could, in the absence of a clean electricity standard, result in a significant increase in GHG emissions from fossil fuel electricity generation (see sensitivity analysis section).

Current and emerging electricity system technologies needed to meet net-zero GHG emissions

A wide range of technologies are available in Canada to form the electricity system, as described in Table 3.

| Technology | Description | Capital cost ($/kW) | Fixed O&M cost ($/kW) | Variable O&M cost ($/MWh) | Average fuel cost ($/MWh) | Estimated operating lifetime (years) |

|---|---|---|---|---|---|---|

| OGCT | Oil/gas combustion turbine (akin to Brayton cycle) | 1,625 | 20 | 6 | 61 | 45 |

| OGCC | Oil/gas combustion turbine equipped with waste heat recovery system and steam turbine (akin to Brayton cycle plus Rankine cycle) | 1,571 | 26 | 4 | 61 | 45 |

| Small OGCC | Similar to OGCC but with lower generating capacity | 1,737 | 33 | 4 | 61 | 45 |

| NG CCS table a3 note ** | Natural gas combustion turbine (typically OGCC though OGCT is possible), equipped with carbon capture and sequestration technology | 3,310 | 51 | 11 | 61 | 45 |

| OG Steam | Steam turbine (akin to Rankine cycle) generation from oil/gas combustion | 5,239 | 135 | 9 | 56 | 45 |

| Coal | Steam turbine generation from coal combustion | 3,825 | 47 | 3 | 13 | 45 |

| Coal CCS table a3 note ** | Steam turbine generation from coal combustion, equipped with carbon capture and sequestration technology | 8,111 | 95 | 11 | 13 | 45 |

| Biomass | Thermal generation utilizing biomass as fuel | 5,634 | 138 | 10 | 3 | 45 |

| Biomass CCS table a3 note ** | Thermal generation utilizing biomass as fuel, equipped with carbon capture and sequestration technology | 10,485 | 192 | 18 | 3 | 45 |

| Waste | Thermal generation utilizing waste material as fuel | 2,085 | 27 | 8 | 13 | 45 |

| Nuclear | Steam turbine generation utilizing nuclear fission as heat source | 9,120 | 167 | 4 | - | 60 |

| Base Hydro | Hydroelectric projects with little or no storage (akin to run-of-river) | 7,071 | 137 | n/a | - | 100 |

| Peak Hydro | Hydroelectric projects with associated reservoirs, able to generate power during peak demand periods | 7,200 | 49 | 2 | - | 100 |

| Pumped Hydro | Hydroelectric projects that are able to store energy for later use | 7,200 | 49 | 2 | - | 100 |

| Small Hydro | Similar to base hydro but with lower generating capacity | 4,362 | 49 | 2 | - | 100 |

| Onshore Wind | Onshore wind turbines | 2,117 | 51 | - | - | 30 |

| Offshore Wind | Offshore wind turbines | 6,370 | 148 | - | - | 30 |

| Solar PV | Photovoltaic solar panels | 1,825 | 18 | - | - | 30 |

| Geothermal | Thermal generation that utilizes geothermal energy to produce steam | 11,712 | 224 | 7 | - | 30 |

| Wave | Process that utilizes wave motion to generate power | 8,905 | 439 | - | - | 20 |

| Storage | Varying technologies capable of consuming energy in one time period then releasing energy in another time period, with an associated efficiency loss | 1,409 | 11 | 1 | - | 15 |

| Other | Other technologies not covered above | 5,462 | 172 | 7 | 32 | 45 |

Table a3 note(s)

|

||||||

Generally speaking, the electricity system technologies in Table 3 can be categorized into unabated emitting generation, abated emitting generation, non-emitting generation and storage. Certain unabated emitting generation technologies are able to reach lower-emitting profiles by burning “clean fuels” such as renewable natural gas or hydrogen. Abated emitting generation technologies reach lower-emitting profiles by deploying abatement technology such as carbon capture and storage (CCS), which can be purpose-built, or installed in some facilities as a retrofit.

There are also emerging electricity system technologies that may become more widely available in Canada as those technologies continue to develop. For example, fuel cells may offer longer-term energy storage than batteries (months or years versus days or weeks) but are currently underutilized since fuel cell technology is not yet sufficiently efficient relative to batteries. Certain advanced variable renewable generation technologies such as offshore wind and geothermal are set to become more available in the medium term (though subject to geological constraints), as are small modular reactors (SMR) which are designed to be more widely deployable than conventional nuclear due to their compact size. Abated emitting generation, non-emitting generation and storage are all expected to contribute significantly to Canada’s future net-zero electricity system, though some degree of technological development will be required to make that happen.

Objective

The objectives of the proposed Regulations are to

- Help Canada achieve its climate change commitments towards achieving net-zero GHG emissions economy-wide by 2050 by constraining emissions from unabated thermal power generation. This transition will support global efforts to address climate change and help limit associated damage; and

- Reduce GHG (i.e. CO2) emissions from emitting electricity generation beginning in 2035.

Description

The proposed Regulations would achieve emission reductions through the application to electricity generating units of an annual basis emission performance standard of 30 tonnes of CO2 per GWh of electricity produced (30 t/GWh), with limited exceptions.

The proposed Regulations apply to all electricity generation units that meet the applicability criteria. A unit means an assembly of equipment that operates together to generate electricity and must include at least a boiler or combustion engine and may include CCS systems.

Further information on the rationale of the regulatory design can be found in Annex 1.

Application

The proposed Regulations would apply to any unit that meets the three following criteria:

- Uses any amount of fossil fuels to generate electricity;

- Has a capacity of 25 MW or greater; and

- Is connected to an electricity system that is subject to North American Electric Reliability Corporation (NERC) standards (NERC-regulated electricity system).

Registration

The proposed Regulations would require all units that meet the applicability criteria to register with the Minister of the Environment by the end of 2025 or, for units commissioned after January 1, 2025, within 60 days of commissioning.

Emission performance standards

The 30 t/GWh annual average performance standard would apply starting on

- January 1, 2035, for units that combust coal or petroleum coke;

- January 1, 2035, for any unit commissioned on or after January 1, 2025;

- January 1, 2035, for a unit that has increased its electricity generation capacity by 10% or more since registration of the unit;

- On the latter of January 1, 2035, or January 1 of the calendar year in which the prohibition set out in subsection 4(2) of the Regulations Limiting Carbon Dioxide Emissions from Natural Gas-fired Generation of Electricityfootnote 19 begins to apply to a “significantly modified” unit, which is one that has ceased burning coal; or

- For any other unit, the latter of January 1, 2035, or 20 years after its commissioning date.

Only units that are net exporters in a given calendar year are subject to the performance standard in that year. Net exporters generate electricity that is supplied to and in some cases, demand electricity from an electricity system regulated by NERC standards. Therefore, the performance standard would only apply to those units that supply more electricity to a NERC-regulated electricity system than they demand from it.

Exceptions from meeting the 30 t/GWh annual average performance standard

In a given calendar year, a unit could comply with the proposed Regulations using one of the following exceptions to the 30 t/GWh annual average performance standard where all of the conditions related to the exceptions are met:

- A unit, other than one combusting coal, that operates up to 450 hours per year (450 hr/yr) may emit no more than 150 kilotonnes of CO2 per year (150 kt/yr), where for clarity, 450 hr/yr is equivalent to operating 24 hours/day for 18.75 days/year; or

- A unit using CCS may emit no more than an annual average of 40 t/GWh if it can demonstrate that the unit is capable of operating at 30 t/GWh (i.e. documentation showing that the unit operated at or below 30 t/GWh for 2 periods of at least 12 consecutive hours, with at least 4 months between those 2 periods in a given calendar year). This exception is only available until the earlier of 7 years after commissioning of a carbon capture and storage (CCS) system or December 31, 2039.

If all of the conditions related to the exceptions are not met in a given calendar year, then the 30 t/GWh annual average performance standard must be complied with in that year.

Furthermore, the proposed Regulations would allow any unit subject to them to operate during any period of emergency circumstance without being required to meet the performance standard during such a period if the unit has been provided an exemption to do so by the Minister of the Environment. In general, an emergency circumstance is one that arises due to an extraordinary, unforeseen, and irresistible event.

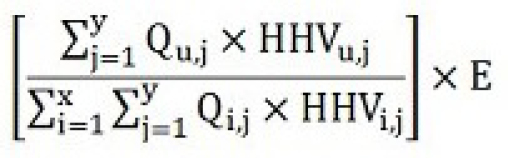

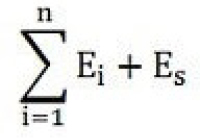

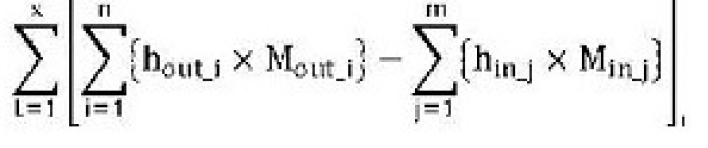

Quantification

The proposed Regulations would set out the manner for determining compliance with the performance standard in a calendar year. In general, for each unit, an operator would need to determine the unit’s emissions intensity, which is the unit’s total emissions divided by its total generation. The quantification requirements apply to each unit annually, as of the calendar year that the prohibition first applies to the unit, regardless of whether the unit is subject to the prohibition in a calendar year,

The unit’s total generation is the quantity of electricity it generated during the course of a year measured on a gross basis.

The unit’s total emissions, which can be determined using either a fuel-based method or continuous emissions monitoring systems (CEMS), includes as applicable

- The quantity of emissions produced by the combustion of fossil fuels for electricity generation; and

- The quantity of emissions associated with the production of any hydrogen fuel or steam that is used by the unit to produce electricity, regardless of the location or supplier.

For clarity, in cases when hydrogen is used as a fuel in the electricity generating unit, the combustion of that hydrogen does not directly produce any CO2 emissions from the unit; therefore, any CO2 emissions associated with the hydrogen’s production must also be quantified and included in the unit’s total emissions.

As included in the proposed Regulations, the unit’s total emissions can exclude the quantity of emissions captured by its CCS system only if these emissions are permanently stored in a storage project that meets prescribed criteria.

Reporting

The proposed Regulations would require all units that meet the applicability criteria to submit a registration report that includes information such as identification of the responsible person; the location and name of the unit; a process diagram of the unit, including the commissioning date of each boiler or combustion engine; the commissioning date of the unit and the unit’s electricity generating capacity.

On an annual basis, the proposed Regulations would require all units that have net exports to an electricity system subject to NERC standards to submit a report that includes information such as the unit’s annual average emission intensity; if applicable, in the case of units with a CCS system installed in the last 7 years, documentation demonstrating that the unit operated at or below 30 t/GWh for 2 periods of at least 12 continuous hours in the reporting year; gross generation; emissions and hours of operation.

A declaration of no net exports may be provided for a unit that does not expect to have any net exports from the time the performance standard would begin to apply to that unit, which would reduce its reporting requirements. If these units never have net exports to the electricity system, they will remain exempt from the prohibition and the quantification requirements in the proposed Regulations.

All units would be required to track their net exports as the performance standard would apply from the applicable year (as of 2035) for that unit if there are net exports in that year. These units would also be subject to quantification rules from the applicable year.

The Regulations Designating Regulatory Provisions for the Purposes of Enforcement (Canadian Environmental Protection Act) would be amended to include the proposed Regulations and make the contravention of applicable rules punishable by appropriate penalties, such as increased fines and jail time.

Regulatory development

Consultation

The Department of the Environment (the Department) started consultations with interested parties to the proposed Regulations in March 2022. Interested parties include utility companies, provincial and territorial governments, Indigenous groups, industry associations, environmental non-governmental organizations (ENGOs), unions and labour organizations, researchers and academics in the field of climate change or energy and the general public.

Starting with the Clean Electricity Standard Discussion Paper, which laid out the Department’s initial proposal on how to achieve a transition to net-zero electricity and introduced the key components that any such policy should incorporate, namely emission reductions, electricity affordability and electricity system reliability. In its proposal, the Department noted that implementing the proposed Regulations would require careful balancing of these three criteria, as maximizing outcomes for any one criterion could place achieving either of the other two at risk. For example, maximizing affordability could endanger emission reductions as the cheapest option to keep the electricity system operating in many places is to continue using existing natural gas-fired generation. In the same way, maximizing reliability may hinder emission reductions as reliability in the status quo requires having sufficient natural gas generation available. An electricity system that is neither affordable, nor reliable could discourage the transition to clean electricity generation needed to achieve the economy-wide net-zero target in 2050.

Interested parties’ engagement

- On March 15, 2022, interested parties were invited to submit comments on the Clean Electricity Standard Discussion Paper which laid out the proposed regulatory approach towards supporting net-zero GHG emissions in the electricity sector by 2035.

- On March 23-24, 2022, interested parties were invited to attend an ’Opening the Loop’ informational webinar on the Discussion Paper. Over 160 submissions were received, following which, a webinar was held on July 21-22, 2022, with a focus on these comments.

- A second round of engagement and consultation began on July 26, 2022, with the publication of the Proposed Regulatory Frame for the Clean Electricity Regulations (“the regulatory frame”) which provided more specifics on the proposed regulatory design. Over 120 submissions were received on the regulatory frame.

- A third webinar was held on September 13-14, 2022, with a focus on modelling assumptions. A number of bilateral modelling sessions were held with various provinces to ensure that the assumptions used in federal modelling were correct.

- On October 3, 2022, an Indigenous information session was hosted, with attendees from First Nations, or their representatives.

As of December 2022, nearly 100 bilateral meetings were held with interested parties to further discuss and provide feedback on the approach of the proposed Regulations.

Following these consultations, more than 330 submissions on the proposal were received. Interested parties commented on

- the role of natural gas and liquid-fired electricity generation post-2035 to ensure reliability of electricity systems;

- the treatment of emitting forms of industrial electricity generation;

- the potential for adverse impacts on electricity rates; and

- the readiness of emerging non-emitting technology to supply reliable electricity by 2035, specifically the availability of generation and storage technologies.

Interested parties have also voiced general support for de-carbonizationfootnote 20 of the electricity system and a willingness to engage in the development of the proposed Regulations to ensure that the regulations would achieve the necessary emissions reductions while maintaining affordability and reliability.

In general, feedback on the proposed Regulatory Frame for the Clean Electricity Regulations (July 26, 2022) was positive, in that many interested parties viewed the proposed regulatory frame as a workable approach to achieving net-zero. However, interested parties raised specific concerns, discussed below, that the Department has considered in depth while developing the proposed Regulations.

Interested parties’ concerns

Natural gas and liquid fuel fired electricity generation post-2035

Many utility companies voiced concern that electricity system operators would not be able to maintain reliability without at least some operation post-2035 from the types of generators that are currently powered by natural gas, or liquid fuel because they are flexible and highly controllable. Many voiced support for an exemption that would allow system operators to use these generators to maintain reliability, as long as it is on a time and emissions-constrained basis.

ENGOs, non-emitting power producers and sustainable industry representatives voiced that the role for natural gas and liquid fuel to power electricity generation should be minimal after 2035 and that a requirement that would limit the use of natural gas would reduce emissions to as close to zero as possible.

To address interested parties’ concerns, the Department has built emissions constrained flexibilities for natural gas and liquid fuel generation into the proposed Regulations to:

- Phase in the performance standard on existing units by applying the standard to any given unit 20 years following its commissioning date, known as a unit’s End of Prescribed Lifefootnote 21 (EoPL);

- Allow covered units to operate in the event of emergency situations without having to meet the performance standards;

- Allow covered units to operate during peaking periods under a total emissions threshold (rather than emissions intensity) and total time limit in a given year without having to meet the intensity-based performance standard; and

- Set the performance standard at a level (i.e. 30 t/GWh) that could be met by natural gas units with CCS so that these units can supply flexible and highly controllable generation to electricity systems.

- Furthermore, the proposed Regulations would allow covered units that are using CCS as part of a compliance strategy to meet an annual average emission intensity of 40 t/GWh for the first 7 years following the capture system’s commissioning, or until December 31, 2039, whichever comes first.

A few utility companies cautioned against allowing too much flexibility for natural gas generation, as this could discourage the rollout of non-emitting generation and energy storage. Furthermore, ENGOs voiced concern that any role for non-emergency gas-fired electricity generation should be greatly limited after 2035. These parties cautioned against underestimating the ability of technologies such as energy storage, hydrogen, CCS, nuclear and other non and low-emitting emerging technologies to ensure electricity system reliability by 2035.

The time limitations incorporated into the above four compliance flexibilities could limit the use of unabated natural gas and liquid fuels for electricity generation in the post-2035 period. It is expected that this would lead to increasing use of non- and low-emitting generation sources.

Higher emitting provinces, utilities, system operators and power producers requested flexibility in the application of the performance standard. Specifically, they shared their concern that, without flexibility, there would be insufficient natural gas capacity to backup variable renewables (e.g. wind and solar) and that units now under construction may not be commissioned in time (by 2025) to benefit from the existing unit EoPL described above.

To address this concern, the proposed Regulations include flexibilities that would

- allow covered units to operate in the event of emergency circumstances; and

- allow covered units to operate if meeting both a total emissions threshold and total time limit in a given year (e.g. mass-based exception to 30 t/GWh performance standard).

ENGOs and industry operating in the clean technology space were seeking clear signals that the proposed Regulations would require electricity system operators to dispatch non-emitting sources in advance of emitting ones. In consideration of these comments, the Department noted that the reliability of electricity systems are of critical importance for provinces and territories, as they are responsible for designing and operating electricity systems. The proposed Regulations set a stringent performance standard, but maintain technology neutrality, allowing provinces and territories, or electricity system operators to choose what types of generation to procure.

Many ENGOs asked for the inclusion of interim standards (i.e. applying a standard before 2035) to avoid a build-out of new natural gas generation before the performance standard applies in 2035. Interim standards are not proposed for the following reasons:footnote 22

- As new natural gas units represent a substantial investment that can only be recouped after 10 or more years of operation, the Department expects that by setting a standard of 30 t/GWh starting in 2035, new units built before 2035 would nonetheless be designed to meet the 30 t/GWh standard so that they could continue to operate past 2035.

- Most of the natural gas units that will come online before 2025 were planned before the proposed Regulations were announced. Few units could be conceived, designed and built before January 1, 2025, the date at which units are counted as “new” under the proposed Regulations and therefore cannot benefit from the 20-year EoPL.

- As an alternative to complying with the 30 t/GWh performance standard, units can instead operate at any emissions intensity for a maximum of 450 hours per year, with a limit of 150 kt/yr, to provide back-up or peaking capacity. It could be possible to commission a new unabated unit after 2025 that could operate under these provisions. This has benefits for geographical regions in Canada that do not have access to the deep geological storage needed for installing CCS technologies. However, it is expected that it would be less financially favourable to only operate a new unit for such a limited amount per year, which would limit the commissioning of new unabated units for this purpose. Furthermore, the total emissions of these units would be less than if they were to operate under the 30 t/GWh emissions standard.

Treatment of industrial emitting electricity generation

Many ENGOs and some utilities shared their concern that there could be a large build-out of industrial electricity generation “behind-the-fence”footnote 23 in order to avoid the proposed Regulations, since electricity units that are not connected to a NERC-regulated electricity system would not be covered under the proposal.

Upon review, the Department noted the following:

- The proposed Regulations are designed to target emissions from the electricity sector. Industrial emissions are subject to other policies, such as carbon pricing.

- The proposed Regulations would cover all generation units that are connected to a NERC-regulated electricity system, regardless of whether or not the units are physically located “behind-the-fence,” i.e. units located at an industrial site.

- In any given compliance year, industrial units that have net exports to a NERC-regulated electricity system (i.e. they sell more electricity than they buy) would have to meet the proposed Regulations’ performance standard in that year. This will create a co-benefit because even electricity produced by units with net exports but used to meet on-site electricity demand would have to meet the 30 t/GWh performance standard. This means that only electricity produced by units that do not have net exports to the electricity system would not have to meet the performance standard.

- Emissions from electricity generation facilities are covered by the Output-Based Pricing System Regulations (OBPSR) or the applicable provincial or territorial carbon pricing system. This means that emissions from units that do not have net exports to a NERC-regulated electricity system in a given year will still be exposed to a price signal to reduce emissions.

- Currently, there are not sufficient, cost-effective low, or non-emitting alternatives for wholly “behind-the-fence” generation. In this context, covering “behind-the-fence” fossil-fired generation units under the proposed Regulations when these units are not net exporters of electricity to a NERC-regulated electricity system would result in negative impacts to industry that would not otherwise occur under the other policies described above (e.g. carbon pricing). Furthermore, “behind-the-fence” units would need to be addressed as Canada moves towards a net-zero economy in 2050.

- In some cases, the fuels that are used in “behind-the-fence” generation would otherwise be required to be flaredfootnote 24 if they were not used for electricity production. As such, if the proposed Regulations were to cover “behind-the-fence” units, it is likely that many of the units would opt to avoid regulatory coverage by ceasing to produce electricity from these fuels and instead flare them. In such scenarios, emissions would increase from the flaring activity without any realized benefit (i.e. electricity generation) from the fuels’ combustion.

For the above reasons, the proposed Regulations would not apply to “behind-the-fence” units that do not have net exports to the grid.

Potential adverse impacts on electricity prices

Some provinces and utilities voiced concerns about the costs of complying with the proposed Regulations and the potential impacts on rate affordability for households, businesses and industry. They noted that fossil-fuel reliant electricity systems would bear higher costs in the net-zero transition than electricity systems that have substantial non-emitting resources, e.g. wind. These interested parties requested funding programs, tax measures and other incentives to minimize the short-term costs of the transition. In particular, provincial governments of New Brunswick and Nova Scotia raised that these provinces experience higher rates of energy povertyfootnote 25 in the country and noted concern that the proposed Regulations could exacerbate this problem.

The Department notes the following:

- Specific engagement was held regarding the analysis of the expected effect on the price of residential electricity.

- Separate from the proposed Regulations and their objectives, the Government of Canada has announced, developed and implemented complementary measures, including funding, to help support the net-zero transition, thereby indirectly reducing the proposed Regulations’ impact on electricity prices.

- The proposed Regulations would include flexibilities that help utilities manage the cost impact of their electricity system while maintaining reliability.

- The Department engaged with a number of academics with expertise in the economics of the electricity system to understand the potential impacts of the proposed Regulations on electricity affordability, which informed the establishment of the regulatory standards and flexibilities within the proposed Regulations. This engagement will continue as the Department considers comments received during the prepublication period.

Readiness of emerging non-emitting technology to supply reliable electricity by 2035

A few utilities, ENGOs, companies operating in the clean technology space and some academics cautioned against allowing too much flexibility for natural gas generation, as this could discourage the rollout of non-emitting generation and energy storage. These parties cautioned against underestimating the ability of technologies such as energy storage, hydrogen-ready gas turbines, CCS, nuclear and other non- and low-emitting emerging technologies to ensure electricity system reliability by 2035.

Several provinces and territories noted that CCS is not a decarbonization option for them because their geology does not allow for carbon storage. Several provinces and territories expressed concern over the readiness of key decarbonization technologies such as CCS, SMR and energy storage, noting that their costs will be very high even when ready for wide-scale deployment. Experts in CCS technology noted that while the 30 t/GWh performance standard is achievable by these systems, there may be periods in the early years of deploying these systems when some adjustments to the systems may be needed in order for them to achieve the performance standard consistently.

The Department notes the following:

- New investments in the development and deployment of emerging technologies such as CCS, energy storage and SMR are anticipated.

- Compliance flexibilities such as prescribed life for units commissioned before January 1, 2025, or the mass-based emission/duration exception allow for continued operation of natural gas and liquid-fired generation in these periods.

- The proposed Regulations contain an exception that allows a covered unit having CCS technology to operate at an average emission intensity of 40 t/GWh if the unit can prove that it is capable of operating at or below 30 t/GWh (i.e. documentation showing that the unit operated at 30 t/GWh for two periods of at least 12 consecutive hours, with at least 4 months between those two periods in a given compliance year) and that:

- The unit can only use the exception for up to 7 years following the commissioning date of that CCS system or until December 31, 2039, whichever comes first.

- During this 7-year period, a unit whose CCS system cannot achieve 30 t/GWh on an annual average basis can continue to operate while the person responsible for the unit undertakes the actions required to improve the unit’s emission performance to meet the 30 t/GWh standard on an annual average basis. These actions could involve multiple rounds of emissions testing, assessing the CCS system for its performance fault, designing the solution to allow for 30 t/GWh operation, building/implementing this solution and commissioning it. Based on the timelines associated with major retrofits of electricity generating units, it is expected that 7 years would provide ample time to take the actions required to improve the CCS system’s performance. By 2040, it is expected that CCS systems will have improved to the point that this flexibility would no longer be needed.

- The CCS exception ensures that the CCS systems are designed to meet an ambitious carbon capture rate, while allowing some minor flexibility in case operational circumstances made it difficult to initially achieve this rate consistently.

Modern treaty obligations and Indigenous engagement and consultation

As required by the Cabinet Directive on the Federal Approach to Modern Treaty Implementation, an assessment of modern treaty implications was conducted for the proposed Regulations. The assessment examined the geographic scope and subject matter of the proposed Regulations in relation to modern treaties in effect. The assessment did not identify any modern treaty implications or obligations.

The Department has taken a distinctions-based engagement approach with Indigenous Peoples:

- Inviting representatives of National Indigenous Organizations (NIOs) to informational webinars;

- Meeting bilaterally with NIOs and extending an open offer to continue meeting on a bilateral basis; and

- Hosting a specific webinar for First Nations to hold a conversation about the proposed Regulations.

Indigenous interested parties have identified energy affordability as a concern that is becoming more acute and recommended that the design of the proposed Regulations protect electricity affordability. Some also expressed that there is strong Indigenous awareness about the impact of health risks from burning fossil fuels and an interest in understanding the benefits of reduced air pollutants that the proposed Regulations could create.

The Department notes that

- Separate from the proposed Regulations and their objectives, the Government of Canada has announced, developed and implemented complementary measures to help support the transition, including funding, that is either targeted for Indigenous-led projects or is available to Indigenous-led projects, thereby indirectly reducing the proposed Regulations’ impact on rates;

- The proposed Regulations would include flexibilities that help utilities manage the cost impact of their electricity system while maintaining reliability;

- The Department has engaged with Indigenous-led organizations with insight into energy affordability in Indigenous communities in order to understand the potential impacts of the Regulations on electricity affordability. This engagement will continue during development of the Regulations; and

- The potential health benefits of the proposed Regulations are discussed further in this regulatory impact analysis statement.

The Department also heard about intersections between the proposed Regulations and broader concerns surrounding economic reconciliation and the participation of Indigenous Peoples in the clean energy transition, particularly through economic participation.

In addition to the above considerations, the Department has reviewed all questions and comments received from Indigenous interested parties and will continue to consider them in the development of the proposed Regulations. Some issues being raised, including Indigenous communities’ views on the energy transition and economic participation, are of interest not just in the context of the proposed Regulations, but also for the broader clean electricity transition.

Instrument choice

The Cabinet Directive on Regulation (CDR) requires departments and agencies to assess the full suite of instruments available (both regulatory and non-regulatory) under federal acts and regulations to select the most effective and appropriate instrument or mix of instruments to address a policy issue. Considering the urgency to address climate change and Canada’s climate change goals towards becoming a net-zero GHG emissions economy by 2050, a transformational change will be required in every sector of the Canadian economy including the electricity-generating sector.

Transforming electricity systems must occur much earlier than 2050, since it requires growth of electricity supply to support the use of more electric technologies, such as electric transportation, heating and cooling of buildings, solutions for various industrial processes and that the electricity generated results in net-zero GHG emissions. If this transformation is not under way by 2035 there is a risk that Canada may not meet its climate change goals of becoming a net-zero GHG emissions economy by 2050.

In determining the most effective and appropriate instrument or mix of instruments that would ensure the electricity-generating sector is on a path to achieve the required transformation by 2035, the Department considered the current federal regulatory regime affecting the sector in the baseline scenario (status quo), including non-regulatory actions. It was determined that the current federal regulatory regime does not ensure that the sector would achieve the required transformation by 2035 and therefore federal regulations would be required. A summary of this assessment is given below:

Baseline scenario / no new controls

The baseline scenario approach involves maintaining existing restrictions on emissions of coal-fired electricity as set out in the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations, which generally set a performance standard of 420 t/GWh. In addition, the baseline scenario approach involves maintaining existing restrictions on emissions of natural gas electricity generation set out in the Regulations Amending the Reduction of Carbon Dioxide Emissions from Coal-fired Generation of Electricity Regulations. These latter Regulations set an emission intensity standard of 420 t/GWh for natural gas boilers or combustion engine units that are 150 MW and greater and an emission intensity standard of 550 t/GWh for combustion engine units that are under 150 MW.

As of 2030, electricity generation capacity from gaseous fuel that meets specified criteria and that was put in place on or after January 1, 2021, whether at an existing or new facility, would be fully exposed to the carbon price. Any such electricity generation capacity that existed prior to 2021 would be subject to the carbon price only for the portion of GHG emissions above the OBS of 370 t/GWh. In the baseline scenario, unabated natural gas generation and associated GHG emissions would be expected to rise in future years as more electric technologies are implemented (e.g. electric transportation) in Canada. This would limit the ability for Canada to achieve net-zero GHG emissions economy-wide by 2050. Most electricity generating facilities are subject to carbon pollution pricing under the federal Output Based Pricing System Regulations (OBPSR), or under provincial or territorial systems that meet the federal benchmark (i.e. the minimum national stringency criterial that all carbon pricing systems in Canada must meet). Under the OBPSR, electricity generation facilities that are covered under the federal system must provide compensation for GHG emissions that are above their facility emissions limit. Compensation can be provided by paying the excess emissions charge ($65/tonne of CO2e in 2023, increasing to $170/tonne in 2030), or by providing one compliance unit (surplus credit, offset credit or recognized provincial offset credit) for each tonne of emissions above their limit. If emissions are below their limit, facilities receive surplus credits for the quantity between the actual emissions and the emissions limit, which can be sold or banked to meet future compliance obligations.

Under the OBPSR, emissions limits are calculated by multiplying a facility’s production by the relevant output-based standard (OBS) associated with the activity, which can be considered a free allocation. Electricity generation is subject to different OBSs based on fuel type. For solid fuel, the OBS started at 800 t/GWh in 2019 and will decrease to 370 t/GWh in 2030. For liquid fuel, the OBS is 500 t/GWh and for gaseous fuel, the OBS is 370 t/GWh. In addition, gas-fired electricity generation facilities that start generating electricity on or after January 1, 2021, and that meet certain size and other designed requirements have an OBS of 370 t/GWh in 2021 decreasing to 0 t/GWh in 2030. This means that in 2030, new gaseous electricity facilities would have no free allocation and would therefore pay for 100% of the GHG emissions emitted from the facility. Modelling by the Department indicates that electricity sector emissions would not decrease sufficiently so as to meet the objectives of the proposed Regulations and could, in fact, increase significantly in the coming decades.

The Government of Canada has core infrastructure investment programs that focus on clean energy system infrastructure with total combined investments of nearly $10 billion. This includes programs such as the Smart Renewables Electrification Pathways Program (SREP), a $1.57 billion program, including $600 million announced in Budget 2022, that provides support for smart renewable energy and electrical grid modernization projects, including projects that support capacity building. From December 2021 to February 2023, the SREP provided funding for about $164.5 million.footnote 18 In Budget 2023, the Government of Canada announced an increase in funding of $3 billion for the SREP.

The Government of Canada provides low-interest financing to clean electricity projects through a variety of mechanisms, including investments and financing from the Canada Infrastructure Bank (CIB) and Strategic Innovation Fund, as well as federal tax incentives. These initiatives total more than $20 billion. This includes the Canada Growth Fund ($15 billion to fund investments in support of a net-zero GHG emissions economy) and funding for the clean power sector announced in Budget 2023 through the Canada Infrastructure Bank ($10 billion through the clean power priority area for building of major clean electricity).

The Government of Canada expects that these investment programs will be of critical importance, as they would work in tandem with the proposed Regulations to help achieve Canada’s goals of transforming the electricity system by 2035 to help achieve a net-zero emissions economy by 2050.

Using carbon pricing to reduce electricity sector emissions

Currently, the minimum national stringency criteria for carbon pricing systems (the federal benchmark) require that explicit carbon price-based systems, such as the federal Output-Based Pricing System, be designed such that the marginal price signal is equal to the benchmark price but allows systems to apply lower average carbon costs to industrial facilities to mitigate carbon leakage and competitiveness risks that can arise due to carbon pricing. Systems do this by requiring facilities to pay the carbon price for emissions above an emissions limit and issuing tradeable credits for facilities that emit below that limit. This approach creates a price signal at the benchmark price on every tonne of emissions but because facilities don’t have to pay the carbon price on all of their emissions, it reduces average carbon costs and risk of carbon leakage and adverse competitiveness impacts.

Reducing GHG emissions from the electricity sector could be achieved by ensuring that a high carbon price is paid for every tonne of electricity emissions. If electricity generators had to pay the carbon price for every tonne of emissions, their average carbon costs would increase. The Department has conducted various modelling exercises and determined that a carbon price of $170/tonne applied to every tonne of electricity sector emissions does not move the sector far enough towards net zero by 2035. Furthermore, in a high-demand modelling scenario, a carbon price of $170/tonne was not found to be sufficiently high so as to make near-zero emission electricity generation technologies significantly more competitive than emitting technologies; if non-emitting and near-zero emission generation technologies are not the most cost competitive options, it is expected that sector emissions would increase. Therefore, while requiring the carbon price to be paid on every tonne of emissions from electricity generation would be expected to achieve additional emission reductions, it would not achieve reductions to the extent needed to achieve the required emission reductions towards net-zero by 2035.

Moreover, the carbon pollution pricing systems in Canada are an economy-wide tool that provides a strong price incentive to reduce emissions in the most cost-effective manner across all emission sources it covers. It provides this strong incentive by its design, which does not set specific limits for emissions from individual sectors. They do not guarantee a certain level of reductions from a specific sector and as such, are not the right tool to ensure achievement of the objective of a net-zero electricity sector.

In the absence of a regulated standard, it is likely to be more economic for utilities to (i) continue to use unabated natural gas to generate reliable baseload power and pay an increased price on pollution, or (ii) to acquire and remit surplus or offset credits. In the absence of other constraints, this would be the choice generators would likely make rather than transition their generating equipment to produce reliable, near-zero emission electricity through technological solutions like wind or solar coupled with energy storage or natural gas coupled with modern CCS technology. Overall, analysis by the Department indicates that requiring electricity generators to pay a high carbon price on all of their emissions would not be sufficient on its own, to guarantee that the electricity sector would achieve by 2035, the transformation required to support Canada’s climate change goal of becoming a net-zero GHG emissions economy by 2050.

The proposed regulatory approach

Reducing GHG emissions to transition towards a net-zero electricity system and to support a net-zero emissions economy by 2050 would require a planned and permanent transition away from unabated electricity generation. The proposed Regulations would build on the existing regulatory framework for the electricity sector to continue progress towards the permanent transition away from unabated fossil-fired electricity generation to low or non-emitting sources of generation. Significant progress in this direction could be accomplished through the application of stringent performance standards within the 2035 time frame. The proposed performance standard would require fossil fuel-fired generation to be abated in order to provide baseload generation. This approach would also provide a clear regulatory reference point that lays out what would constitute clean electricity, while providing power producers with timelines adequate to adjust their capital investment plans. However, given that the proposed performance standard would be set at a non-zero value and that the proposed regulatory approach would include several compliance flexibilities, the electricity generation sector would continue to have low levels of residual emissions. Additional actions would be needed before the electricity generation sector could fully achieve net-zero emissions.

Within the proposed regulatory approach, the Department considered several options for key parameters including the emissions performance standard, compliance flexibilities, capacity threshold, industrial generation coverage and an End of Prescribed Life. The impacts of varying these parameters are assessed in the sensitivity analysis section of the RIAS.

Regulatory analysis

Benefits and costs

Data sources and analytical parameters

A cost-benefit analysis (CBA) is undertaken to determine the incremental impacts (costs and benefits) accrued under a regulatory scenario relative to those accrued under a baseline scenario. For this proposal, the CBA compares the difference in impacts between a scenario with the proposed Regulations and a scenario without them. The main driver of incremental impacts for the proposed Regulations is the electricity system mix modelled in the baseline scenario versus that modelled in the regulatory scenario. In the CBA, electricity system mix refers to the set of infrastructure that makes up the electricity system (e.g. non-emitting generation assets, abated emitting generation assets, emitting generation assets, storage assets and transmission lines that connect between electric utility systems), the technical specifications of that infrastructure (e.g. capacity, generation, fuel usage, emissions intensity, operation and maintenance factors) and the usage of that infrastructure (e.g. electricity system only generation, industrial generation, back-up or emergency generation). Under the proposed Regulations, Canada’s electricity system mix would shift towards low or non-emitting sources of electricity generation more quickly and to a greater extent than it would under the baseline scenario and there would be greater investment in storage and transmission capacity.

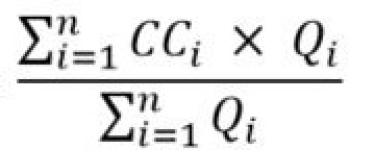

The electricity system mix and related factors that could be realized under a baseline scenario versus under a regulatory scenario were projected by two departmental models. The first model is NextGrid, which is a capacity expansion model that identifies optimal investment and operation decisions across Canada’s electricity system, minimizing the system-wide (national) cost of meeting demand subject to many constraints including policy parameters, system reliability and resource availability (e.g. geological constraints). The second model is the Energy, Emissions and Economy Model for Canada (E3MC), which itself contains two components. The first component of E3MC is Energy 2020 (E2020), which is an integrated, multi-region, multi-sector North American model that simulates the supply, price and demand for all fuels. E2020 estimates energy output and prices for each sector in regulated and unregulated markets and simulates how energy prices and government measures may affect the choices that consumers and businesses make when they buy and use energy. E2020’s outputs include changes in energy use, energy prices, greenhouse gas emissions, air pollutant emissions, investment costs and possible cost savings from measures, which are used to identify the direct effects stemming from measures aimed at reducing GHG emissions. The resulting savings and investments from E2020 are then used as inputs into the second component of E3MC, The Informetrica Model (TIM). TIM is used to examine consumption, investment, production and trade decisions in the whole economy. It captures the interactions among industries, as well as the implications for changes in producer prices, relative final prices and income. It also factors in government fiscal balances, monetary flows and interest and exchange rates. TIM projects the direct impacts on the economy’s final demand, output, employment, price formation and sectoral income that result from various policy choices. These, in turn, permit an estimation of the effect of climate change policy and related impacts on the national economy.footnote 26

NextGrid and E3MC are capable of modelling electricity system mixes in Canada out to 2050 and base their results on optimization algorithms and constraints that are distinct to each model, utilizing data from a multitude of sources including Statistics Canada and ongoing collaboration with provinces and utilities. To the extent possible and where appropriate, underlying assumptions and application of the proposed Regulations have been aligned between E3MC and NextGrid to produce results from both models that can be used in tandem throughout the CBA. In the CBA, electricity system mix in the baseline scenario was modelled by E3MC, while electricity system mix in the policy scenario was modelled by NextGrid and E3MC. Specifically, NextGrid modelled the decisions that may be made by existing units that do not meet the CO2 emissions intensity limit starting in 2035 (i.e. retire early, retrofit with CCS, or change operation regime to operate under the mass-based emission/duration flexibility), while E3MC modelled the decisions that may be made by all other units. NextGrid was also used to model and cost out new interprovincial transmission lines that may be constructed in the regulatory scenario. Aside from those transmission lines, all other electricity system and economy-wide cost inputs used in the CBA were derived by E3MC. The CBA uses outputs from E3MC and NextGrid to present a distribution of impacts deemed attributable to the proposed Regulations, while acknowledging a variety of external economic and environmental changes that may occur over the analytical period by using conservative assumptions where appropriate and by testing alternative parameters in sensitivity analysis.

It is important to note that the proposed Regulations do not prescribe any particular compliance pathway onto any particular unit that does not meet the CO2 emissions intensity limit starting in 2035. All results presented in the RIAS represent a modelled scenario indicating what may occur in response to the proposed Regulations based on reasonable constraints and assumptions (i.e. central case modelling). The central case scenario does not represent the only path that the electricity-generating sector could take to comply with the regulatory requirements and should not be interpreted as being more probable than other potential paths. Likewise, it is important to acknowledge the vast degree of uncertainty when modelling structural changes associated with economic decarbonization over a long-time horizon. A wide range of outcomes are ultimately possible, which could be driven by new or unanticipated technological development, alongside macroeconomic factors, demographic shifts and policy landscapes at all levels of government that may fundamentally alter baseline modelling.

Under the proposed Regulations, certain administrative costs to industry would begin in 2024 upon anticipated registration of the Regulations. Results from E3MC indicate that changes to Canada’s electricity system mix and associated changes to system costs could begin as early as 2026 in anticipation of the CO2 emission intensity limit coming into force starting in 2035. Because of this and Canada’s goal to achieve net-zero emissions by 2050, the analytical time frame chosen for the CBA is 2024 to 2050 (a 27-year period). Unless otherwise stated, all costs and monetized benefits are presented in 2022 constant dollars, discounted to base year 2023 at a discount rate of 2%. This is the near-term Ramsey discount rate now utilized by the Government of Canada when monetizing GHG reductions and is informed by the most current state of climate science (more information on this approach is presented in the benefits subsection). In all tables that follow, totals may not add up due to rounding.

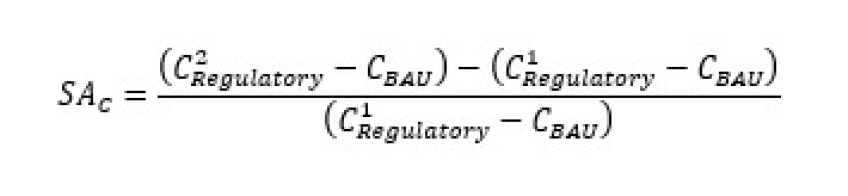

Key modelling assumptions in the CBA