Canada Gazette, Part I, Volume 155, Number 40: MISCELLANEOUS NOTICES

October 2, 2021

CO-OPERATORS GENERAL INSURANCE COMPANY

COSECO INSURANCE COMPANY

LETTERS PATENT OF AMALGAMATION

Notice is hereby given, pursuant to the provisions of section 250 of the Insurance Companies Act (Canada), that Co-operators General Insurance Company and COSECO Insurance Company (together, the “Applicants”) intend to make a joint application to the Minister of Finance, on or after October 4, 2021, for letters patent of amalgamation continuing the Applicants as one company under the name “Co-operators General Insurance Company” in English and “La Compagnie d’assurance générale Co-operators” in French. The head office of the amalgamated company would be located in Guelph, Ontario.

The effective date of the proposed amalgamation would be December 31, 2021, or any other date fixed by the letters patent of amalgamation.

September 3, 2021

Co-operators General Insurance Company

COSECO Insurance Company

FIRST WEST CREDIT UNION

NOTICE PURSUANT TO THE DISCLOSURE ON CONTINUANCE REGULATIONS (FEDERAL CREDIT UNIONS)

Date: September 27, 2021

To: Members of First West Credit Union

Members of First West Credit Union (“First West”) will vote on special resolutions that, among other things, authorize First West to apply to become a federal credit union under the Bank Act. Members should consider the information contained in this Notice before deciding how to vote. Votes can be submitted between November 1, 2021, and November 21, 2021.

Pursuant to the Disclosure on Continuance Regulations (Federal Credit Unions) [the “Regulations”], this Notice is being provided to members of First West to inform them of the changes to deposit insurance that will apply to their eligible deposits held by First West if First West becomes a federal credit union and, on that same day, a member of the Canada Deposit Insurance Corporation (“CDIC”).

Deposit insurance is designed to protect certain deposits in case the financial institution holding them fails. Deposit insurance automatically applies to eligible deposits held at a financial institution as long as that financial institution is a member of a deposit protection agency.

Deposits currently held with First West are insured by the Credit Union Deposit Insurance Corporation (“CUDIC”). CUDIC insures deposits held at credit unions that are incorporated in British Columbia. If First West obtains the necessary member and regulatory approvals and becomes a federal credit union, it will automatically become a member of CDIC. As a result, CUDIC deposit insurance will no longer apply to the deposits held by First West and deposits eligible under CDIC’s deposit insurance will be insured by CDIC.

WHAT THIS NOTICE COVERS

In accordance with the Regulations, this Notice provides information regarding certain changes that will come into effect if First West becomes a federal credit union. Specifically, this Notice includes information on

- the day on which CUDIC deposit insurance coverage for deposits held with First West would end and CDIC deposit insurance coverage would begin;

- a description of the CUDIC coverage that currently applies to deposits held with First West;

- CDIC coverage that would apply to pre-existing deposits held with First West during the transition period; and

- CDIC coverage that would apply to deposits held with First West after the transition period and how this coverage differs from the pre-continuance CUDIC deposit insurance coverage applicable to eligible deposits currently held with First West.

In addition to this Notice, information regarding the special resolution to authorize First West to apply to become a federal credit union and the change from CUDIC coverage to CDIC coverage that would result from becoming a federal credit union is included in the member package prepared by First West in connection with the special resolution vote. This information is also available at any First West branch or by visiting keepgrowing.ca. First West has included examples to help members understand the changes to deposit insurance coverage if First West becomes a federal credit union and members should review this information in connection with their vote.

IMPORTANT THINGS TO NOTE

The information included in this Notice is current as of the date of this Notice. Deposit insurance coverage offered by CUDIC and/or CDIC may change in the future. If there are material changes to deposit insurance coverage offered by CUDIC and/or CDIC before and if First West becomes a federal credit union, First West may revise this Notice accordingly.

The publishing of this Notice and receiving approval from the members of First West to apply to become a federal credit union does not guarantee First West will become a federal credit union. First West requires the approval of Canada’s Minister of Finance and other regulatory bodies and there is no guarantee First West will receive these approvals. If such approvals are not received, First West will not be able to become a federal credit union. In addition, there is no guarantee First West will become a federal credit union on the dates referenced in this Notice or in any other document that provides a date on which First West may become a federal credit union. Additionally, there is no guarantee First West will become a federal credit union under the conditions stated in this Notice or any other document.

WHAT HAPPENS ON CONTINUATION DAY

The continuation day is the date First West would become a federal credit union. This date would be indicated in the Letters Patent of Continuance issued by Canada’s Minister of Finance. On the same day, the Order to Commence and Carry on Business, issued by the Superintendent of Financial Institutions, will become effective. On the continuation day, First West will become a member of CDIC and on the same day, CUDIC deposit insurance will no longer apply to deposits held by First West, including to those deposits not eligible for CDIC coverage. Instead, CDIC deposit insurance will apply to deposits held by First West that are eligible for CDIC coverage.

As of the publication date of this Notice, First West has not submitted an application to continue as a federal credit union, and the federal Minister of Finance has not rendered her or his decision on First West’s continuation as a federal credit union, nor has there been any indication of approval to occur in the future.

DEPOSITS TO WHICH CUDIC DEPOSIT INSURANCE CURRENTLY APPLIES

Table 1 below describes which eligible deposits currently held with First West are insured by CUDIC. Until the continuation day, the full amount of such deposits, including accrued interest, is covered by CUDIC’s deposit insurance.

| Deposits Held in One Name | Deposits in a Trust Account | Deposits in an RRSP | Deposits in an RRIF | Deposits in a TFSA | Deposits in More Than One Name (Joint Deposits) | |

|---|---|---|---|---|---|---|

| Savings accounts (including foreign currency deposits) | Yes | Yes | Yes | Yes | Yes | Yes |

| Chequing accounts (including foreign currency deposits) | Yes | Yes | Not Applicable | Not Applicable | Not Applicable | Yes |

| GIC and other term deposits (including foreign currency deposits, and regardless of term to maturity) | Yes | Yes | Yes | Yes | Yes | Yes |

| Non-equity shares table 1 note A and declared but unpaid dividends on such shares | Yes | Yes | Yes | Yes | Yes | Yes |

| Money orders, certified cheques, traveller’s cheques, debentures, bank drafts and prepaid letters of credit in respect of which a credit union is primarily liable | Yes | Yes | Not Applicable | Not Applicable | Not Applicable | Yes |

Table 1 note(s)

|

||||||

WHAT IS NOT COVERED BY CUDIC DEPOSIT INSURANCE?

CUDIC deposit insurance does not apply to all financial instruments or securities held with First West. Specifically, the following are not covered by CUDIC deposit insurance:

- membership shares issued by a credit union;

- equity shares issued by a credit union;

- shares issued by other corporations;

- mutual funds;

- bonds, notes, treasury bills and debentures issued by governments or corporations;

- money orders, certified cheques, traveller’s cheques, debentures, drafts and prepaid letters of credit in respect of which a credit union is not primarily liable; and

- principal-protected notes.

ABOUT TRANSITIONAL CDIC INSURANCE COVERAGE

On the continuation day, deposits held with First West would be covered by CDIC deposit insurance so long as those deposits are eligible for CDIC coverage. On the continuation day, CUDIC deposit insurance would no longer apply, including to those deposits not eligible for CDIC coverage.

A transition period would begin on the continuation day. During the transition period, any “pre-existing” deposits that are eligible under CDIC’s deposit insurance coverage would be insured by CDIC to the same extent as the current CUDIC deposit insurance coverage described above. A “pre-existing” deposit is a deposit held by First West on the continuation day. During the transition period, CDIC deposit insurance coverage would not apply to the following:

- deposits that are payable outside of Canada;

- deposits in respect of which the Government of Canada is a preferred claimant;

- investments in non-equity shares and declared but unpaid dividends on those shares; and

- traveller’s cheques.

The transition period for pre-existing demand deposits would end 180 days after the continuation day. In the case of a pre-existing deposit that is to be repaid on a fixed day (i.e. a term deposit or a GIC), the transition period would end on the maturity date or when it is cashed out.

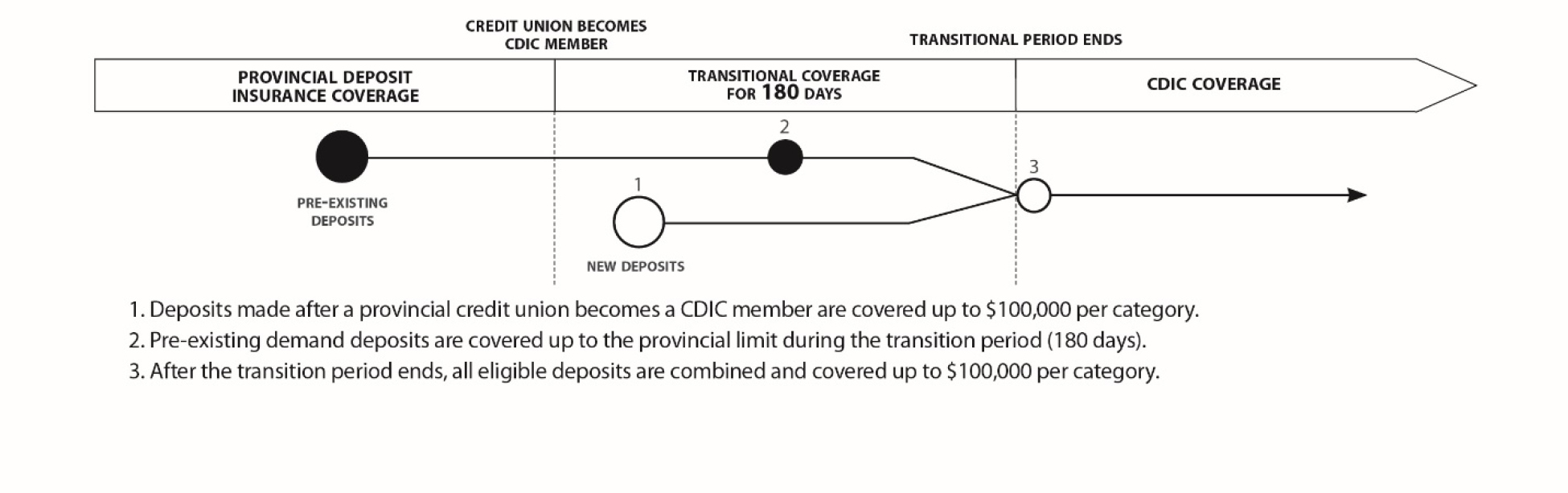

Figure 1: Transitional Coverage of Demand Deposits

(e.g. Chequing/Savings Accounts)

Figure 1 - Text version

Provincial deposit insurance coverage will apply to pre-existing deposits of the credit union member until the day the provincial credit union becomes a CDIC member. Deposits made after a provincial credit union becomes a CDIC member are covered up to $100,000 per category. Pre-existing demand deposits are covered up to the provincial limit during the transition period (180 days). After the transition period ends, all eligible deposits are combined and covered up to $100,000 per category.

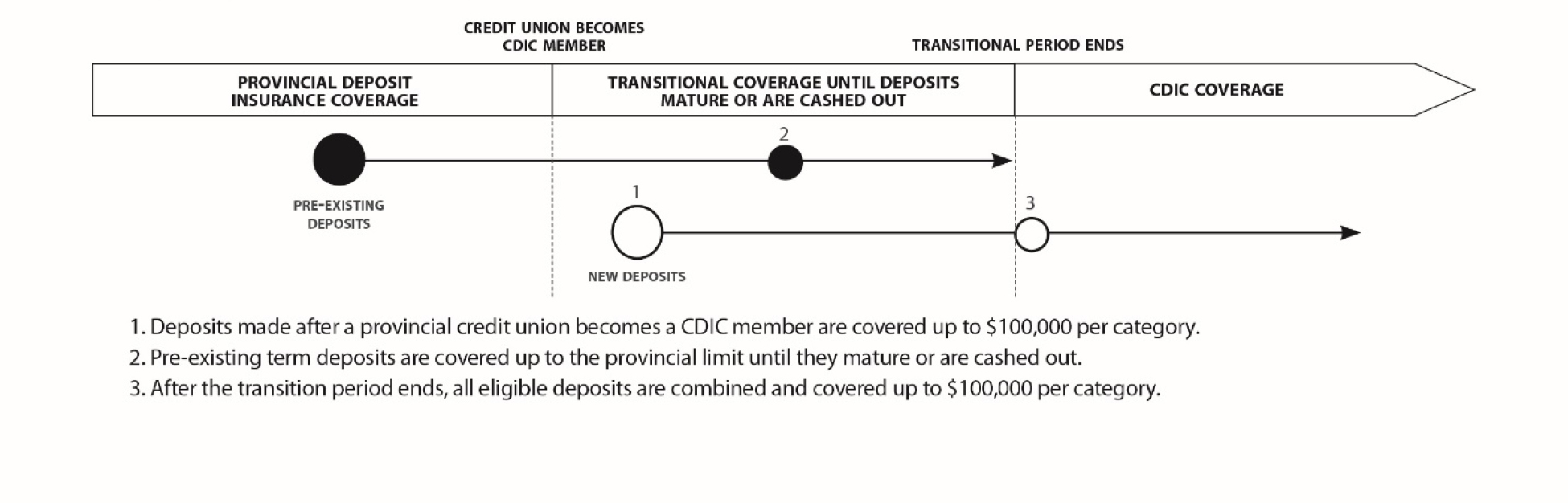

Figure 2: Transitional Coverage of Term Deposits

(e.g. GICs)

Figure 2 - Text version

Provincial deposit insurance coverage will apply to pre-existing deposits of the credit union member until the day the provincial credit union becomes a CDIC member. Deposits made after a provincial credit union becomes a CDIC member are covered up to $100,000 per category. Pre-existing term deposits are covered up to the provincial limit until they mature or are cashed out (i.e. the transition period). After the transition period ends, all eligible deposits are combined and covered up to $100,000 per category.

As shown in the diagram above, and keeping in mind the exceptions to CDIC coverage noted in this Notice, if the continuation day was January 1, 2023, any eligible pre-existing deposit that is not for a fixed period would have unlimited coverage until June 29, 2023, inclusive, less any amounts withdrawn during this period. Any eligible pre-existing deposit that is for a fixed term, keeping in mind the exceptions to CDIC coverage noted in this Notice, would have unlimited coverage until the end of that fixed term.

It is important to note that CDIC transitional coverage does not apply to deposits made with First West on or after the continuation day. If a deposit is made with First West during the transition period, the deposit would be treated as a separate deposit from any pre-existing deposits and would be covered by the standard CDIC deposit insurance described below.

Once the transition period ends, the CDIC standard deposit insurance coverage described in the next section would apply to all CDIC eligible deposits held with First West. For the purpose of determining deposit insurance coverage per insurance category, eligible pre-existing deposits would be combined with eligible deposits made on or after the continuation day.

ABOUT STANDARD CDIC INSURANCE COVERAGE

CDIC eligible deposits made with First West on or after the continuation day would be covered by CDIC’s standard insurance coverage. This CDIC coverage is the same for all CDIC member institutions.

Below is a summary of certain differences between the insurance coverage provided by CDIC and CUDIC:

- Coverage limit: Eligible deposits currently held with First West are subject to CUDIC’s insurance coverage, and CUDIC provides deposit insurance for the full amount of the deposit. Eligible deposits held with CDIC member institutions are subject to CDIC’s deposit insurance coverage and CDIC provides deposit insurance to a maximum of $100,000 (including principal and interest) for each of the categories, in each of its member institutions (categories are summarized in Table 2 below). This means that if you have deposits in more than one category, you will be insured for up to $100,000 in each of those categories, for each CDIC member institution.

- Government of Canada as a preferred claimant: CDIC does not provide deposit insurance coverage for deposits in respect of which the Government of Canada is a preferred claimant. No such restriction is expressed in respect of CUDIC deposit insurance.

- Investments in non-equity shares: CDIC does not provide deposit insurance coverage for money invested in non-equity shares. CUDIC provides insurance coverage for money invested in non-equity shares and dividends declared on such shares that have not been paid (“non-equity shares” are those issued by a credit union prior to January 1, 2020). Further, note First West’s membership shares and Class B equity shares are not insured by either CUDIC or CDIC.

- Traveller’s cheques: CDIC does not provide deposit insurance coverage for traveller’s cheques. CUDIC provides insurance coverage for traveller’s cheques in respect of which a credit union is primarily liable.

| Deposits held in one name | Deposits in a trust account | Deposits in an RRSP | Deposits in an RRIF | Deposits in a TFSA | Deposits in more than one name (joint deposits) | |

|---|---|---|---|---|---|---|

| Savings accounts (including foreign currency deposits) | Yes | Yes | Yes | Yes | Yes | Yes |

| Chequing accounts (including foreign currency deposits) | Yes | Yes | Not applicable | Not applicable | Not applicable | Yes |

| GIC and other term deposits (regardless of term to maturity) | Yes | Yes | Yes | Yes | Yes | Yes |

| Money orders, certified cheques, debentures, bank drafts and prepaid letters of credit in respect of which a credit union is primarily liable | Yes | Yes | Not applicable | Not applicable | Not applicable | Yes |

| Debentures issued as proof of deposit for CDIC member institutions (other than banks) | Yes | Yes | Yes | Yes | Yes | Yes |

Table 3: Changes to CDIC deposit insurance coming into effect on April 30, 2022

Effective April 30, 2022, RESPs and RDSPs will be introduced as two new categories of deposits eligible for CDIC deposit insurance. Also effective April 30, 2022, deposits held to pay property taxes on mortgaged properties will remain eligible for deposit insurance but will no longer have a separate insurance category and coverage limit. These deposits will be combined with eligible deposits in other categories such as savings in one name.

| Deposits in an RESP | Deposits in an RDSP | |

|---|---|---|

| Savings accounts (including foreign currency deposits) | Yes | Yes |

| Chequing accounts (including foreign currency deposits) | Not applicable | Not applicable |

| GIC and other term deposits (regardless of term to maturity) | Yes | Yes |

| Money orders, certified cheques, debentures, bank drafts and prepaid letters of credit in respect of which a credit union is primarily liable | Not applicable | Not applicable |

| Debentures issued as proof of deposit for CDIC member institutions (other than banks) | Yes | Yes |

WHAT IS NOT COVERED BY CDIC INSURANCE COVERAGE?

Not everything held with a CDIC member institution is protected by CDIC insurance coverage. Specifically, the following are not covered by CDIC deposit insurance coverage:

- membership shares issued by a federal credit union;

- any shares issued by a federal credit union;

- debentures issued by a federal credit union;

- deposits not payable in Canada;

- shares issued by other corporations;

- mutual funds;

- traveller’s cheques;

- bonds, notes, treasury bills, and debentures issued by governments or corporations;

- money orders, certified cheques, drafts, and prepaid letters of credit in respect of which a federal credit union is not primarily liable;

- principal-protected notes (with some exceptions);

- safe-deposit box contents; and

- securities held for safekeeping.

QUESTIONS

More information on deposit insurance may be found at