Canada Gazette, Part I, Volume 153, Number 11: Regulations Amending the Canada Not-for-profit Corporations Regulations

March 16, 2019

Statutory authority

Canada Not-for-profit Corporations Act

Sponsoring department

Department of Industry

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the Regulations.)

Issues

Services fees under the Canada Not-for-profit Corporations Act (NFP Act) have not changed since 2011. Some fees need to be better aligned with the cost of delivering the related services, and need to better reflect the objectives of optimizing the design and delivery of services and increasing the uptake of digital services.

Background

The NFP Act provides the corporate governance framework for federal non-share capital corporations including small, local organizations as well as large, national organizations. The corporations under the NFP Act include, but are not limited to, non-profits and registered charities under the Income Tax Act. The fees administered by Corporations Canada under the NFP Act are prescribed in the Canada Not-for-profit Corporations Regulations (the Regulations) and were set in 2011.

The 2011 fees introduced lower fees for two services — incorporation and annual return filings — based on the method of filing: online or not online. Incorporation and annual return filings were the first services offered online. Currently, 7 out of 15 services are available online with 88% of applications submitted online. Though lower in volume, the remaining services are being considered for online development.

Over the past decade, the digital economy has evolved dramatically. Stakeholders expect effective services that are integrated, simple, timely and secure. Within that context, the Government of Canada’s Policy on Service aims to achieve better service experience, increase the number and uptake of e-services and provide more efficient services.

Objectives

The objectives of the proposed amendments are to better align service fees under the NFP Act with the cost of delivering the related services and to achieve the following principles and objectives as identified by Corporations Canada and the Government of Canada:

- encourage the use of low-cost service delivery methods;

- promote compliance with the NFP Act; and

- support greater corporate transparency.

Description

Below is a summary of the proposed changes, followed by a table setting out the proposed fee changes under the NFP Act.

Certificates

Service fees related to certificates issued under the NFP Act would increase to $250 for applications that are not filed online. This will better align the non-online applications with their higher cost of delivery. This differentiation would encourage clients to choose the more efficient service delivery method.

Priority services

For a number of years, clients have asked Corporations Canada to develop a priority service in relation to applications under the NFP Act that would allow for faster processing times when needed. This type of service is currently offered by some provincial corporate regulators.

A new priority service for online applications is being proposed. Clients would pay $100 in addition to the application fee. The additional fee would afford clients a shorter turnaround time.

The priority service would only apply to applications for certificates of incorporation, amendment, continuance, amalgamation and revival of a dissolved corporation, and for letters of satisfaction. These are the services for which clients typically request a faster turnaround time.

The priority service would only apply to applications that are submitted online to discourage non-online applications. The only exception is for services that are currently not offered online, namely certificates of continuance, amalgamation, revival and letters of satisfaction under the NFP Act.

Annual returns

There is a requirement under the NFP Act for every corporation to file an annual return to allow Corporations Canada to keep its database of federal corporations up to date. It is proposed to reduce the fee for filing an annual return online to $12 from the current fee of $20. The non-online fee would not change.

Reducing the fee would result in cost savings for all corporations including the many small corporations that are created by the NFP Act. It would also encourage corporations to file online and promote the Department’s focus on client-centric digital services.

Cancellations and corrections

A new fee is proposed for applications to cancel a certificate. Currently, there is no fee for a cancellation application. However, there is a fee of $200 for a correction application. Both cancellation and correction services are processed similarly and therefore have similar costs.

The proposal is to add a new fee of $250 for cancellations and increase the current fee for corrections to $250 to align it more closely to the cost of delivering the service. Requests for corrections or cancellations resulting from an error that is solely attributable to the Director appointed under the NFP Act would continue to be free.

Certificates of compliance or existence

With regards to certificates of compliance or existence, the proposal is to increase the fee for non-online applications to $20 and keep the online fee the same at $10. This would better align the cost of processing the filing.

Intent to dissolve and revocation of intent to dissolve

It is proposed that the fee for filing a revocation of intent to dissolve a corporation be increased from $50 to $100 for non-online requests. This would better align the cost of processing the filing.

Copy fee for corporate records

The proposal is to provide copies of corporate records for free when requested online. Making online requests for copies free would increase corporate transparency and would benefit many stakeholders, including corporations and the general public.

There are additional costs for processing non-online requests for copies; therefore, the fee for these requests would be $5 per document. There would be no fee for such requests from police and law enforcement and other federal, provincial or municipal governments and agencies that use the corporate information for compliance and investigative activities.

Certified copy fee for corporate records

The fees related to certified copies of corporate records filed with Corporations Canada would also change. The online fee would be $10 per document, which is a $25 reduction from the current fee. For non-online requests, the fee would be $40 per document, which represents the current fee of $35 plus the new copy fee of $5.

No fee payable for certain amendments of articles

To encourage higher compliance with the requirements of the NFP Act, it is proposed to remove the fee for online requests to amend articles when the change relates only to the province in which the registered office is located, to the number of directors, or to both.

Corporations are required to have a registered office address in the province indicated in their articles of incorporation. If they want to change the province of the registered office, they are required to amend their articles. Discussions with clients have indicated that sometimes corporations do not keep the registered office address up-to-date because they would have to pay a $200 fee to amend the articles.

The no-fee approach would also apply to online applications to change the number of directors in the articles. Some corporations may be deterred from updating their director information if the number of directors does not correspond with the number indicated in the articles. By removing this fee, it is anticipated that the level of compliance with the NFP Act would improve.

Fee for certificate of arrangement

It is proposed to increase the fee for reviewing arrangement transactions from the current fee of $200 to $500. The increase in fee takes into account the costs of reviewing arrangements prior to the issuance of a certificate of arrangement.

An arrangement is a complex corporate transaction that is supervised by a court. Corporations Canada reviews the court applications to ensure compliance with the requirements at both the interim and final order stages of the court process. Once a final court order is received, Corporations Canada issues a certificate of arrangement by the Director. Only one arrangement application has ever been received under the NFP Act.

Fee for exemption applications

A number of exemption applications are available under the NFP Act for a service fee of $250 except for exemption applications to delay an annual meeting, to give notice of annual meetings using an alternative method and to deem the gross annual revenues of a soliciting corporation. A new fee of $250 is proposed for these exemption applications since they are processed similarly and therefore have similar costs to the other exemption applications.

Restated articles

The proposal is to increase the fee for online and non-online applications for restated articles of incorporation to $100 from the current $50. The $100 fee would also apply to restated articles that are filed with articles of amendment, for which there is currently no fee. This will better align the fee with the cost of providing the service.

Periodic escalator clause

The Service Fees Act requires each fee to be increased each fiscal year based on the percentage change in the Consumer Price Index (CPI), as published by Statistics Canada for the previous fiscal year. The objective of the annual increase is to ensure that service fees keep pace with the increase in the cost of providing the service so that the potential for funding gaps are eliminated. An annual increase is not required if the fees are adjusted periodically by an escalator clause set out in the Regulations.

An escalator clause that better reflects Corporations Canada’s experience is being proposed for the Regulations. Specifically, the escalator clause would

- have the first increase take effect on April 1, 2024, and every five years thereafter; and

- increase each fee by 1%, rounded down to the nearest five dollars.

This approach would eliminate the need for annual increases to the service fees to minimize costly changes including to Corporations Canada IT system. The proposed escalator clause also takes into account Corporations Canada’s experience with its ongoing efforts to reduce costs. The result has been that, for many years, the revenue collected by Corporations Canada has been sufficient to cover the costs of providing the services. It is expected that as more businesses opt to use its online services, this will continue in the future.

| Canada Not-for-profit Corporations Act Service Standards Changes |

|||

|---|---|---|---|

| Service | Method | Current Fee | Proposed Fee |

| Annual return | Online | $20 | $12 |

| Non-online | $40 | No change | |

|

Online | $200 | No change |

| Non-online | $200 | $250 | |

| Amendment | Online | $200 | No change |

| Online if only province and number of directors |

$200 | Free | |

| Non-online | $200 | $250 | |

| Letter of satisfaction | Online | $200 | No change |

| Non-online | $200 | $250 | |

| Restated articles | Online or non-online | $50 | $100 |

| Arrangement | Online or non-online | $200 | $500 |

| Revocation of intent to dissolve | Online | $50 | No change |

| Non-online | $50 | $100 | |

| Priority service (new online only service) | Online | N/A | $100 + application fee |

| Non-online if online not developed | N/A | $100 + application fee | |

| Certificate of compliance or existence | Online | $10 | No change |

| Non-online | $10 | $20 | |

| Cancelled certificate | Online or non-online | Free | $250 |

| Corrected certificate | Online or non-online | $200 | $250 |

| Exemptions — most applications | Online or non-online | $250 | No change |

| Exemptions for annual meetings and gross annual revenues | Online or non-online | Free | $250 |

| Copies of documents | Online | N/A | Free |

| Non-online | $1 per page | $5 per document | |

| Copies of documents for police or governments | Online | $1 per page | Free |

| Non-online | $1 per page | Free | |

| Copy of a corporate profile (online service only) | Online | $1 per page | Free |

| Certified copies of documents | Online | N/A | $10 |

| Non-online | $35 per document certified | $40 per document certified including the copy fee | |

Benefits and costs

Following the review of the cost for each service, the proposal would make several adjustments to service fees. Given the higher costs for processing non-online applications (via email, fax or mail), the majority of the changes would result in a fee increase for those transactions while the fee for online applications remains the same.

For a few of the services, the proposed fee would be lower than the current fee. For example, the proposed fee is $12 for online annual returns, which is $8 lower than the current fee of $20. The reduction in this fee is a benefit for corporations who file their annual return online, which is 95% of annual returns filed in 2017–2018. It is anticipated that the lower fee for online annual returns will result in a decrease in revenue for Corporations Canada of $128,709 in 2019–2020.

To encourage compliance, the fee would be removed for online amendments to the articles to change the province of the registered office, the number of directors or both. It is anticipated that this proposal will result in a decrease in revenue for Corporations Canada of $50,527 in 2019–2020.

Copies of corporate documents would also be available for free online to make this information more accessible. Providing this information free would be a benefit to many stakeholders, including corporations and the general public. It is anticipated that the removal of the fee will result in a decrease of $3,526 in revenue for Corporations Canada in 2019–2020.

The proposed increases to fees are small and generally only apply to non-online applications. With 91% of applications filed online, the number of applications for which the fee would be increased is low. Using the fiscal year 2017—2018 as an example for the number of transactions, Corporations Canada processed a total of 45 198 fee transactions under the NFP Act. Of those, 648 were transactions for services that are not available online.

Furthermore, the number of transactions with an online application and a fee increase that only applies to the non-online process is also low (263 transactions). For these transactions, the increased cost for corporations would be $13,150. Since the service is offered online, clients requesting that service can avoid the increase in costs by using the online service. It is anticipated that lower fees for online applications will reduce the number of non-online applications.

Summary

The proposal has fees that are both increasing and decreasing, with direct benefits for corporations and the general public of $2,924,000 (present value) from 2019–2020 to 2029–2030. The benefit for corporations would result in a reduction of an equal amount to Corporations Canada’s revenue. At the same time, the proposal would increase the fees for various paper-based transactions, which would result in an increase to Corporations Canada’s revenue and increased costs for corporations of $2,533,000 (present value) over the same period.

The overall reduction in fees will not impact negatively Corporations Canada, corporations or the general public. Without the reduction to some fees, there is concern of an accumulation of surplus in Corporations Canada’s accounts. By better aligning fees with the costs of providing the service, any surplus will be limited. Corporations Canada does not anticipate any additional costs or consequential effect on its operating budget as a result of this regulatory proposal. The level of service will not be affected. In the past, increasing demand has increased revenue at a higher rate than the rate of cost increases. Corporations Canada’s analysis has indicated that this pattern will continue. There would be no risk to the fiscal framework.

Offering lower fees for online service will encourage corporations to file online and promote the Department’s focus on client-centric digital services. It is anticipated that removing the fee for online requests to amend articles when the change relates only to the province in which the registered office is located or to the number of directors, or to both, will encourage higher compliance with the requirements of the NFP Act. Currently, some corporations are not keeping the registered office address up-to-date because they are reluctant to pay the $200 fee to amend the articles.

Also, providing free access to copies of corporate records when requested online will increase corporate transparency and would benefit stakeholders (i.e. potential investors, financial institutions, creditors) including the corporations and the general public. Making copies free increases the availability of accurate information on corporations. Accurate information is required for the effectiveness and efficiency of the NFP Act framework.

| Base Year: 2019–2020 | Final Year: 2029–2030 | Total (PV) |

Annualized Average | |

|---|---|---|---|---|

A. Quantified impacts Benefits (in Can$, 2017 price level / constant dollars) Benefits to corporations and intermediaries |

||||

| Reduction in fees of various online transactions | $263,000 | $248,000 | $2,924,000 | $416,000 |

| Benefits to Corporations Canada | ||||

| Increase in fees for various paper transactions | $250,000 | $212,000 | $2,533,000 | $361,000 |

| Total benefits | $513,000 | $460,000 | $5,457,000 | $777,000 |

Cost (in Can$, 2017 price level / constant dollars) Costs to corporations and intermediaries |

||||

| Increase in costs of various paper transactions | $250,000 | $212,000 | $2,533,000 | $361,000 |

| Costs to Corporations Canada | ||||

| Reduction in revenues collected | $263,000 | $248,000 | $2,924,000 | $416,000 |

| Total costs | $513,000 | $460,000 | $5,457,000 | $777,000 |

| Net benefits | $0 | $0 | ||

| Qualitative impacts | ||||

|

||||

A discount rate of 7% has been used.

Projected revenues

The proposal will result in a reduction of online fees collected of $263,000 in the first year, mostly benefiting existing corporations’ maintenance costs. Corporations Canada will collect $250,000 more in revenue related to paper transactions in the first year, better aligning the fees with the costs to provide these services. Overall, new and existing corporations will benefit from a net annualized average reduction of $55,000.

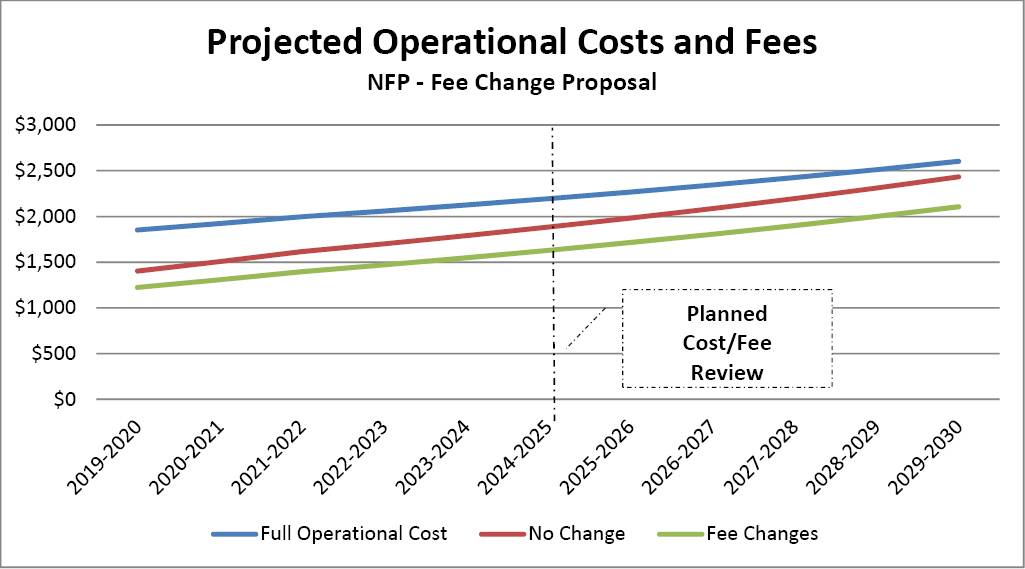

Projected operational costs and fees

The costs of services are expected to grow at a stable ratio in the coming years along with revenues. The cost-benefit analysis provided the opportunity to represent the growing gap between revenues and costs, prompting a change in fees with the goal of realigning them with costs. The graphic below demonstrates this well. A considerable gap can be seen between costs and revenue if no changes are applied. The fee changes have a positive impact on standardizing fees for similar services and have a positive effect on aligning costs and revenue overall. This is important as an organization funded through a net voting authority.

A review is planned five years following the implementation of the fee changes, which will arrive at an appropriate time to determine if changes are needed once again to realign costs and revenue.

The costs and benefits of the proposed amendments are based largely on a cost-benefit analysis prepared by Corporations Canada. Revenue projections were based on 15 years of historic transaction volumes. Although Corporations Canada provides various types of services, the historical data for incorporations (or new corporations created in a time period) were used for projections, because this transaction type (almost on its own) defines the total number of clients Corporations Canada serves, which in turn determines the volume dynamics of all other transactions types. The volume of incorporation was used to establish the growth trend line applicable to the NFP Act. The trend has a growth rate of 5.28% for incorporations and other transaction types. The transactions related to maintaining or closing a corporation were calculated as a ratio dependent on incorporation volumes and active corporation volumes as these rations are steady and provided stability to the model.

By choosing to use a historical trend line for projections, Corporations Canada acknowledges that there are various factors influencing federal incorporations, many of which are related to each other in a complex and not easily measurable way, and assumes that the net effect is going to largely remain the same as in the past few years. Corporations Canada recognizes that the latter assumption is strong, but at the moment is unable to make more reliable projections for such a long time span.

It has to be noted that price elasticity of transaction volumes have been analyzed by Corporations Canada on two occasions and the effect has been measured. More specifically, the effect of changes in incorporation fees on the decision whether to incorporate federally or provincially has been analyzed and proven to exist. However, since incorporation fees are proposed to remain unchanged for this amendment, the net elasticity effect is assumed to be non-existent (i.e. the assumption is that, while deciding whether to incorporate federally or provincially, businesses do not compare federal and provincial fees other than incorporation fees).

Based on these elements, an interactive projection model determined the impact on revenue and costs of any specific fee changes, for the next 10 years.

“One-for-One” Rule

The “One-for-One” Rule does not apply to this proposal, as there is no change in administrative costs to business.

Small business lens

The small business lens does not apply to this proposal, since not-for-profit corporations are not considered businesses. Further, not-for-profit corporations, including small corporations, are expected to benefit overall from reduced fee payments as a result of the proposal.

Consultation

On May 31, 2018, information was posted on the Innovation, Science and Economic Development Canada website about public consultations on proposed changes to the service fees under the Canada Business Corporations Act, the NFP Act and the Canada Cooperatives Act. Two comments were received in response to the consultations. One comment supported the proposed changes and considered them reasonable. The other comment objected to service fees being charged to not-for-profit corporations, claiming that these corporations do not have money to pay them and that the aggregate increases do not benefit the not-for-profit corporations. The service fees are charged to corporations are being set to reflect the cost of providing the service and to encourage online filing. The take-up of online filing is high so most corporations will not see an increase. Overall, the proposed fee changes will reduce the costs for corporations and, if the service is available online, the increase in the fee can be avoided if the request is filed online.

Rationale

Fees for services under the NFP Act have not changed since 2011. The proposed amendments would make a variety of fee changes to encourage the use of low-cost delivery methods, promote compliance with the NFP Act, and support greater transparency. Overall, the impact of the fee changes is expected to generate a net reduction of Corporations Canada revenue of $ 2.9M (present value) over 10 years. This would also lead to an equivalent cost saving for corporations and the general public and limit future surpluses by better aligning the costs and revenues of Corporations Canada. Stakeholders were consulted and only one comment was received in opposition, which has not resulted in any changes to the proposal.

Implementation, enforcement and service standards

Implementation

The proposed regulatory amendments are targeted to come into force on January 15, 2020.

As part of the implementation of the amendments, a communication strategy would include notices to stakeholders about the changes to the fees and updates to the Corporations Canada website and Online Filing Centre.

Enforcement

The NFP Act requires fees to be paid before the associated application is processed by Corporations Canada. If a user fails to pay a fee, then the service will not be provided in accordance with standard practice.

Service standards

Currently, service standards are generally 1 business day for online requests and 5 business days for non-online requests, with a few exceptions such as corrections, cancellations, arrangements and exemptions. The intent is to have the general online service standard remain at 1 business day and the non-online standard increase to 10 business days.

| Canada Business Corporations Act Service Standard Changes |

|||

|---|---|---|---|

| Service | Method | Current | Proposed |

| Annual return | Online | 1 day | No change |

| Non-online | 5 days | 10 days | |

|

Online | 1 day | No change |

| Non-online | 5 days | 10 days | |

| Amendment | Online | 1 day | No change |

| Online if only province and number of directors | 1 day | No change | |

| Non-online | 5 days | 10 days | |

| Letter of satisfaction | Online | 1 day | No change |

| Non-online | 5 days | 10 days | |

| Restated articles | Online or non-online | 5 days | 10 days |

| Arrangement | Online or non-online | 5 days | No change |

| Revocation of intent to dissolve | Online | 1 day | No change |

| Non-online | 5 days | 10 days | |

| Priority service (new online only service) | Online | N/A | Expedited |

| Non-online if online not developed | Expedited | ||

| Certificate of compliance or existence | Online | 1 day | No change |

| Non-online | 1 day | 10 days | |

| Cancelled certificate | Online or non-online | 20 days | 10 days |

| Corrected certificate | Online or non-online | 20 days | 10 days |

| Copies of documents | Online | 1 day for active corporations / 6 days for inactive corporations | 1 day |

| Non-online | 1 day for active corporation / 6 days for inactive corporations | 10 days | |

| Copies of documents for police or governments | Online | 1 day for active corporation / 6 days for inactive corporations | 1 day |

| Non-online | 1 day for active corporations / 6 days for inactive corporations | 10 days | |

| Copy of a corporate profile (online service only) | Online | 1 day | 1 day |

| Certified copies of documents | Online | N/A | 1 day |

| Non-online | 1 day for active corporations / 6 days for inactive corporations | 10 days | |

| All other services | Non-online | Varies |

10 days |

Contact

Comments received during the 30-day public comment period will be taken into consideration and will be summarized in the Regulatory Impact Analysis Statement submitted to the Governor in Council to support approval of the proposed amendments and published in Part II of the Canada Gazette. The statement will not contain any personal information that could be used to identify individual stakeholders, and submissions should not contain any confidential or personal information. Business contact information will be collected and may be used for future business consultations conducted by Innovation, Science and Economic Development Canada.

Innovation, Science and Economic Development Canada

Attention: Coleen Kirby

Manager

Policy Section

Corporations Canada

Telephone: 1-866‑333‑5556

Email: ic.corporationscanada.ic@canada.ca

PROPOSED REGULATORY TEXT

Notice is given that the Governor in Council, pursuant to paragraph 293(1)(c) of the Canada Not-for-profit Corporations Act footnote a, proposes to make the annexed Regulations Amending the Canada Not-for-profit Corporations Regulations.

Interested persons may make representations concerning the proposed Regulations within 30 days after the date of publication of this notice. All such representations must cite the Canada Gazette, Part I, and the date of publication of this notice, and be addressed to Coleen Kirby, Manager, Policy Section, Corporations Canada, Innovation, Science and Economic Development Canada (tel.: 1-866‑333‑5556; email: ic.corporationscanada.ic@canada.ca).

Ottawa, February 28, 2019

Jurica Čapkun

Assistant Clerk of the Privy Council

Regulations Amending the Canada Not-for-profit Corporations Regulations

Amendments

1 Section 94 of the Canada Not-for-profit Corporations Regulationsfootnote 1 is replaced by the following:

94 (1) The fee in respect of a service set out in items 1 to 3 of column 1 of the schedule is the applicable fee set out in column 2.

(2) No fee is payable for

- (a) receipt and examination by the Director of articles of amendment sent under section 200 of the Act, if the only purpose of the amendment is to do one or more of the following:

- (i) add an English or a French version to the corporation’s name,

- (ii) change the corporation’s name as directed by the Director under subsection 13(2), (3) or (4) of the Act, or

- (iii) if the articles are sent using the online service of the Director, change the province in which the registered office is situated or the number of directors;

- (b) receipt and examination by the Director of documents sent under subsection 288(1) of the Act or a request referred to in subsection 288(3) of the Act, if the error was made solely by the Director;

- (c) receipt and examination by the Director of a request for a cancellation referred to in subsection 289(1) of the Act, in the circumstance referred to in paragraph 93(1)(b) of these Regulations; or

- (d) provision by the Director of

- (i) an uncertified copy or uncertified extract under subsection 279(2) of the Act, if it is requested by a department or agency of the government of Canada, the government of a province or municipality or a police or law enforcement agency in Canada, or

- (ii) an uncertified copy or uncertified extract of a profile of a corporation generated by the Director.

(3) In addition to the applicable fees set out in item 1 of the schedule, the fee set out in item 4 of the schedule is to be paid for

- (a) the expedited examination of any of the following documents:

- (i) articles of amalgamation sent under subsection 208(1) of the Act,

- (ii) articles of continuance sent under subsection 211(4) of the Act,

- (iii) a request for a document evidencing the satisfaction of the Director for the purpose of subsection 213(1) of the Act, or

- (iv) articles of revival sent under subsection 219(2) of the Act; or

- (b) the expedited examination of any of the following documents, if sent using the online service of the Director:

- (i) articles of incorporation sent under section 8 of the Act, or

- (ii) articles of amendment sent under section 200 of the Act.

94.1 The fees set out in column 2 of the schedule are to be adjusted on April 1, 2024 and every five years after that date by increasing them by one percent and rounding down to the nearest multiple of five dollars.

2 The schedule to the Regulations is replaced by the schedule set out in the schedule to these Regulations.

Coming into Force

3 These Regulations come into force on January 15, 2020.

SCHEDULE

(Section 2)

SCHEDULE

(Subsections 94(1) and (3) and section 94.1)

| Item | Column 1 Service under the Act |

Column 2 Fee ($) |

|---|---|---|

1 |

Receipt and examination by the Director of |

|

(a) an application made under subsection 2(6), 25(1) or (2), 104(3), 160(2), 162(5) or 171(2) or section 173, 190 or 271 |

250 |

|

(b) articles of incorporation sent under section 8 |

||

|

200 |

|

|

250 |

|

(c) articles of amendment sent under section 200 or articles of reorganization sent under subsection 215(4) |

||

|

200 |

|

|

250 |

|

(d) restated articles of incorporation sent under subsection 203(2) |

100 |

|

(e) articles of amalgamation sent under subsection 208(1) |

||

|

200 |

|

|

250 |

|

(f) articles of continuance sent under subsection 211(4) |

||

|

200 |

|

|

250 |

|

(g) a request for a document evidencing the satisfaction of the Director for the purpose of subsection 213(1) |

||

|

200 |

|

|

250 |

|

(h) articles of arrangement sent under subsection 216(5) |

500 |

|

(i) articles of revival sent under subsection 219(2) |

||

|

200 |

|

|

250 |

|

(j) a statement of revocation of intent to dissolve sent under subsection 221(10) |

||

|

50 |

|

|

100 |

|

(k) an annual return sent under section 278 |

||

|

12 |

|

|

40 |

|

(l) documents sent under subsection 288(1) or a request referred to in subsection 288(3) |

250 |

|

(m) a request for a cancellation referred to in subsection 289(1) or a request referred to in subsection 289(3) |

250 |

|

(n) request for certificate referred to in subsection 290(1) |

||

|

10 |

|

|

20 |

|

2 |

Provision by the Director of an uncertified copy or uncertified extract under subsection 279(2), if requested using any means other than the online service of the Director, per copy or extract |

5 |

3 |

Provision by the Director of a certified copy or certified extract under subsection 279(2) |

|

(a) if requested using the online service of the Director, per copy or extract |

10 |

|

(b) if requested using any other means, per copy or extract |

40 |

|

4 |

Expedited examination by the Director |

100 |