Canada Gazette, Part I, Volume 153, Number 3: GOVERNMENT NOTICES

January 19, 2019

DEPARTMENT OF THE ENVIRONMENT

CANADIAN ENVIRONMENTAL PROTECTION ACT, 1999.pg

Notice with respect to reporting of greenhouse gases (GHGs) for 2018

Notice is hereby given, pursuant to subsection 46(1) of the Canadian Environmental Protection Act, 1999 (the Act), that, with respect to emissions of GHGs identified in Schedule 1 to this notice and for the purpose of conducting research, creating an inventory of data, formulating objectives and codes of practice, issuing guidelines or assessing or reporting on the state of the environment, any person who operates a facility described in Schedule 3 to this notice during the 2018 calendar year, and who possesses or who may reasonably be expected to have access to information described in Schedules 4 through 18 to this notice, shall provide the Minister of the Environment with this information no later than June 1, 2019.

Persons subject to this notice shall address responses or enquiries to the following address:

Greenhouse Gas Reporting Program

Pollutant Inventories and Reporting Division

Environment and Climate Change Canada

Place Vincent Massey, 7th Floor

351 Saint-Joseph Boulevard

Gatineau, Quebec

K1A 0H3

Telephone: 819‑938‑3258 or 1‑877‑877‑8375

Email: ec.ges-ghg.ec@canada.ca

This notice applies to the calendar year 2018. Pursuant to subsection 46(8) of the Act, persons subject to this notice shall keep copies of the information required under this notice, together with any calculations, measurements and other data on which the information is based, at the facility to which the calculations, measurements and other data relate, or at the facility’s parent company, located in Canada, for a period of three years from the date the information is required to be submitted. Where the person chooses to keep the information required under the notice, together with any calculations, measurements and other data, at the facility’s parent company in Canada, that person shall inform the Minister of the civic address of that parent company.

If a person who operates a facility with respect to which information was submitted in response to the Notice with respect to reporting of greenhouse gases (GHGs) for 2017 determines that the facility does not meet the criteria set out in Schedule 3 of this notice, the person shall notify the Minister of the Environment that the facility does not meet those criteria no later than June 1, 2019.

The Minister of the Environment intends to publish information on greenhouse gas emission totals by gas per facility submitted in response to this notice. Pursuant to section 51 of the Act, any person who provides information in response to this notice may submit, with their information and no later than the deadline for submission, a written request that the information be treated as confidential based on the reasons set out in section 52 of the Act. The person requesting confidential treatment of the information shall indicate which of the reasons stipulated in section 52 of the Act applies to their request. Nevertheless, the Minister may decide to disclose the information submitted in response to this notice, in accordance with subsection 53(3) of the Act. Every person to whom this notice is directed shall comply with the notice. A person who fails to comply with the requirements of the notice will be liable under the applicable offence provisions of the Act.

Jacqueline Gonçalves

Director General

Science and Risk Assessment Directorate

On behalf of the Minister of the Environment

SCHEDULE 1

Greenhouse Gases

| Greenhouse Gas | Formula | CAS Registry Number table 1 note 1 | 100-year Global Warming Potential (GWP) table 1 note 2 | |

|---|---|---|---|---|

| 1. | Carbon dioxide | CO2 | 124-38-9 | 1 |

| 2. | Methane | CH4 | 74-82-8 | 25 |

| 3. | Nitrous oxide | N2O | 10024-97-2 | 298 |

| 4. | Sulphur hexafluoride | SF6 | 2551-62-4 | 22 800 |

Hydrofluorocarbons (HFCs) |

||||

| 5. | HFC-23 | CHF3 | 75-46-7 | 14 800 |

| 6. | HFC-32 | CH2F2 | 75-10-5 | 675 |

| 7. | HFC-41 | CH3F | 593-53-3 | 92 |

| 8. | HFC-43-10mee | C5H2F10 | 138495-42-8 | 1 640 |

| 9. | HFC-125 | C2HF5 | 354-33-6 | 3 500 |

| 10. | HFC-134 | C2H2F4 (Structure: CHF2CHF2) | 359-35-3 | 1 100 |

| 11. | HFC-134a | C2H2F4 (Structure: CH2FCF3) | 811-97-2 | 1 430 |

| 12. | HFC-143 | C2H3F3 (Structure: CHF2CH2F) | 430-66-0 | 353 |

| 13. | HFC-143a | C2H3F3 (Structure: CF3CH3) | 420-46-2 | 4 470 |

| 14. | HFC-152a | C2H4F2 (Structure: CH3CHF2) | 75-37-6 | 124 |

| 15. | HFC-227ea | C3HF7 | 431-89-0 | 3 220 |

| 16. | HFC-236fa | C3H2F6 | 690-39-1 | 9 810 |

| 17. | HFC-245ca | C3H3F5 | 679-86-7 | 693 |

| Perfluorocarbons (PFCs) | ||||

| 18. | Perfluoromethane | CF4 | 75-73-0 | 7 390 |

| 19. | Perfluoroethane | C2F6 | 76-16-4 | 12 200 |

| 20. | Perfluoropropane | C3F8 | 76-19-7 | 8 830 |

| 21. | Perfluorobutane | C4F10 | 355-25-9 | 8 860 |

| 22. | Perfluorocyclobutane | c-C4F8 | 115-25-3 | 10 300 |

| 23. | Perfluoropentane | C5F12 | 678-26-2 | 9 160 |

| 24. | Perfluorohexane | C6F14 | 355-42-0 | 9 300 |

Table 1 Notes

|

||||

SCHEDULE 2

Definitions

The following definitions apply to this notice and its schedules:

- “2006 Intergovernmental Panel on Climate Change (IPCC) Guidelines” means the 2006 IPCC Guidelines for National Greenhouse Gas Inventories, prepared by the Intergovernmental Panel on Climate Change National Greenhouse Gas Inventories Program. [Lignes directrices 2006 du Groupe intergouvernemental d’experts sur l’évolution du climat (GIEC) pour les inventaires nationaux de gaz à effet de serre]

- “aluminium production” means primary processes that are used to manufacture aluminium from alumina, including electrolysis in prebake and Søderberg cells, anode and cathode baking for prebake cells, and green coke calcination. (production d’aluminium)

- “ammonia production” means processes in which ammonia is manufactured from fossil-based feedstock produced by steam reforming of a hydrocarbon. This also includes processes where ammonia is manufactured through the gasification of solid and liquid raw material. (production d’ammoniac)

- “base metal production” means the primary and secondary production processes that are used to recover copper, nickel, zinc, lead, and cobalt. Primary production includes the smelting or refining of base metals from feedstock that comes primarily from ore. Secondary production processes includes the recovery of base metals from various feedstock materials, such as recycled metals. Process activities may include the removal of impurities using carbonate flux reagents, the use of reducing agents to extract metals or slag cleaning, and the consumption of carbon electrodes. (production de métaux communs)

- “biomass” means plants or plant materials, animal waste or any product made of either of these, including wood and wood products, charcoal, and agricultural residues; biologically derived organic matter in municipal and industrial wastes, landfill gas, bio-alcohols, black liquor, sludge digestion gas and animal- or plant-derived oils. (biomasse)

- “bone dry tonnes” means biomass solids that contain zero percent (0%) moisture. (tonnes de matières sèches)

- “Canada’s Greenhouse Gas Quantification Requirements” means Canada’s Greenhouse Gas Quantification Requirements, Greenhouse Gas Reporting Program, Environment and Climate Change Canada, 2018. (Exigences relatives à la quantification des gaz à effet de serre du Canada)

- “carbon dioxide equivalent (CO2 eq.)” means a unit of measure for comparison between greenhouse gases that have different global warming potentials (GWPs).footnote 1 [équivalent en dioxyde de carbone (éq. CO2)]

- “CAS Registry Number” means the Chemical Abstracts Service Registry Number. (numéro d’enregistrement CAS)

- “cement production” means all processes used to manufacture portland, ordinary portland, masonry, pozzolanic or other hydraulic cements. (production de ciment)

- “CEMS” means Continuous Emission Monitoring Systems. (SMECE)

- “CKD” means cement kiln dust. (PFC)

- “CO2 capture” means the capture of CO2 at an integrated facility that would otherwise be directly released to the atmosphere. (capture de CO2)

- “CO2 emissions from biomass decomposition” means releases of CO2 resulting from aerobic decomposition of biomass and from the fermentation of biomass. (émissions de CO2 provenant de la décomposition de la biomasse)

- “CO2 injection” means an activity that places captured CO2 into a long-term geological storage site or an enhanced fossil fuel recovery operation. (injection de CO2)

- “CO2 recovered” means the recovery/capture of CO2 at a hydrogen plant that would typically be delivered for downstream use in other manufacturing industries, used in on-site production or sent to permanent storages. (CO2 récupéré)

- “CO2 storage” means a long-term geological formation where CO2 is stored. (stockage de CO2)

- “CO2 transport system” means transport of captured CO2 by any mode. (système de transport de CO2)

- “cogeneration unit” means a fuel combustion device which simultaneously generates electricity and either heat or steam. (unité de cogénération)

- “Continuous Emission Monitoring Systems” means the complete equipment for sampling, conditioning, and analyzing emissions or process parameters and for recording data. (Systèmes de mesure et d’enregistrement en continu des émissions)

- “CSM” means cyclohexane-soluble matter. (MSC)

- “electricity generating unit” means any device that combusts solid, liquid, or gaseous fuel for the purpose of producing electricity either for sale or for use on-site. This includes cogeneration units, but excludes portable or emergency generators that have less than 50 kW in nameplate generating capacity or that generate less than 2 MWh during the reporting year. (unité de production d’électricité)

- “emissions” means direct releases to the atmosphere from sources that are located at the facility. (émissions)

- “enhanced fossil fuel recovery operation” means enhanced oil recovery, enhanced natural gas recovery and enhanced coal bed methane recovery. (opération améliorée de récupération des combustibles fossiles)

- “ethanol production” means processes that produce grain ethanol for the use in industrial applications or as a fuel. (production d’éthanol)

- “facility” means an integrated facility, a pipeline transportation system, or an offshore installation. (installation)

- “flaring emissions” means controlled releases of gases from industrial activities, from the combustion of a gas or liquid stream produced at the facility, the purpose of which is not to produce useful heat or work. This includes releases from waste petroleum incineration; hazardous emission prevention systems (in pilot or active mode); well testing; natural gas gathering systems; natural gas processing plant operations; crude oil production; pipeline operations; petroleum refining; chemical fertilizer production; steel production. (émissions de torchage)

- “fossil fuel production and processing” means the exploration, extraction, processing including refining and upgrading, transmission, storage and use of solid, liquid or gaseous petroleum, coal or natural gas fuels, or any other fuels derived from these sources. (production et transformation de combustibles fossiles)

- “fugitive emissions” means releases from venting, flaring or leakage of gases from fossil fuel production and processing; iron and steel coke oven batteries; CO2 capture, transport, injection and storage infrastructure. (émissions fugitives)

- “GHGs” means greenhouse gases. (GES)

- “GWP” means global warming potential. (PRP)

- “HFCs” means hydrofluorocarbons. (HFC)

- “hydrogen production” means processes that produce hydrogen gas by steam hydrocarbon reforming, partial oxidation of hydrocarbons, or other transformation of hydrocarbon feedstock. This activity may occur at bitumen upgraders; petroleum refineries; chemical plants; fertilizer plants; stand-alone industrial gas producers and, where needed, for purification or synthesis of substances. (production d’hydrogène)

- “industrial process emissions” means releases from an industrial process that involves a chemical or physical reaction the primary purpose of which is to produce a product, as opposed to useful heat or work. This does not include venting from hydrogen production associated with fossil fuel production and processing. (émissions liées aux procédés industriels)

- “industrial product use emissions” means releases from the use of a product, in an industrial process, that is not involved in a chemical or physical reaction and does not react in the process. This includes releases from the use of SF6, HFCs and PFCs as cover gases, and the use of HFCs and PFCs in foam blowing. This does not include releases from PFCs and HFCs in refrigeration, air conditioning, semiconductor production, fire extinguishing, solvents, aerosols and SF6 in explosion protection, leak detection, electronic applications and fire extinguishing. (émissions associées à l’utilisation de produits industriels)

- “integrated facility” means all buildings, equipment, structures, on-site transportation machinery, and stationary items that are located on a single site, on multiple sites or between multiple sites that are owned or operated by the same person or persons and that function as a single integrated site. “Integrated facility” excludes public roads. (installation intégrée)

- “iron and steel production” means primary iron and steel production processes, secondary steelmaking processes, iron production processes, coke oven battery production processes, iron ore pellet firing processes, or iron and steel powder processes. (production de fer et d’acier)

- “leakage emissions” means accidental releases and leaks of gases from fossil fuel production and processing, transmission and distribution; iron and steel coke oven batteries; CO2 capture, transport, injection and storage infrastructure. (émissions dues aux fuites)

- “lime production” means all processes that are used to manufacture a lime product by calcination of limestone or other calcareous materials. (production de chaux)

- “mining” means the mining, beneficiating or otherwise preparing metallic and non-metallic minerals, including coal. (exploitation minière)

- “NAICS” means the North American Industry Classification System. (SCIAN)

- “nitric acid production” means the use of one or more trains to produce weak nitric acid that is 30 to 70 percent in strength. A nitric acid train produces weak nitric acid through the catalytic oxidation of ammonia followed by the absorption of nitrogen oxides by water. The absorber tail gas contains unabsorbed nitrogen oxides, including nitrous oxide emissions of which may be reduced by abatement technologies. (production d’acide nitrique)

- “offshore installation” means an offshore drilling unit, production platform or ship, or sub-sea installation that is attached or anchored to the continental shelf of Canada in connection with the exploitation of oil or natural gas. (installation extracôtière)

- “on-site transportation emissions” means releases from machinery used for the transport or movement of substances, materials, equipment or products that are used in the production process at an integrated facility. This includes releases from vehicles without public road licences. (émissions liées au transport sur le site)

- “petroleum refineries” means processes used to produce gasoline, aromatics, kerosene, distillate fuel oils, residual fuel oils, lubricants, asphalt, or other products through the distillation of petroleum or through redistillation, cracking, rearrangement or reforming of unfinished petroleum derivatives. This includes catalytic cracking units; fluid coking units; delayed coking units; catalytic reforming units; coke calcining units; asphalt blowing operations; blowdown systems; storage tanks; process equipment components (i.e. compressors, pumps, valves, pressure relief devices, flanges, and connectors) in gas service; marine vessel, barge, tanker truck, and similar loading operations; flares; sulphur recovery plants; and non-merchant hydrogen plants that are owned or under the direct control of the refinery owner and operator. This does not include facilities that distill only pipeline transmix. (raffineries de pétrole)

- “PFCs” means perfluorocarbons. (PFC)

- “pipeline transportation system” means all pipelines that are owned or operated by the same person within a province or territory that transport/distribute CO2 or processed natural gas and their associated installations, including meter sets and storage installations but excluding straddle plants or other processing installations. (gazoducs)

- “pulp and paper production” means separating cellulose fibres from other materials in fibre sources to produce pulp, paper and paper products. This includes converting paper into paperboard products, or operating coating and laminating processes. (production de pâtes et papiers)

- “reporting company” means a person who operates one or more facilities that meet the reporting criteria as set out in Schedule 3 of this notice. (société déclarante)

- “stationary fuel combustion emissions” means releases from stationary fuel combustion sources, in which fuel is burned for the purpose of producing useful heat or work. This includes releases from the combustion of waste fuels to produce useful heat or work. (émissions de combustion stationnaire de combustible)

- “stationary fuel combustion sources” means devices that combust solid, liquid, gaseous, or waste fuel for the purpose of producing useful heat or work . This includes boilers, electricity generating units, cogeneration units, combustion turbines, engines, incinerators, process heaters, and other stationary combustion devices, but does not include emergency flares. (sources de combustion stationnaires)

- “surface leakage” means CO2 emitted from geological formations used for long-term storage of CO2. (fuites en surface)

- “venting emissions” means controlled releases of a process or waste gas, including releases of CO2 associated with carbon capture, transport, injection and storage; from hydrogen production associated with fossil fuel production and processing; of casing gas; of gases associated with a liquid or a solution gas; of treater, stabilizer or dehydrator off-gas; of blanket gases; from pneumatic devices which use natural gas as a driver; from compressor start-ups, pipelines and other blowdowns; from metering and regulation station control loops. (émissions d’évacuation)

- “waste emissions” means releases that result from waste disposal activities at a facility including landfilling of solid waste, flaring of landfill gas, and waste incineration. This does not include releases from the combustion of waste fuels to produce useful heat or work. (émissions des déchets)

- “wastewater emissions” means releases resulting from wastewater and wastewater treatment at a facility. (émissions des eaux usées)

- “Weights and Measures Act” means the Weights and Measures Act. (Loi sur les poids et mesures)

SCHEDULE 3

Reporting criteria

1. This notice applies to any person who operates

- (a) a facility that emits 10 000 t of carbon dioxide equivalent (10 kt CO2 eq.) or more (the “reporting threshold”) of the GHGs listed in Table 1 of Schedule 1 in the 2018 calendar year;

- (b) a facility that emits 10 000 t of carbon dioxide equivalent (10 kt CO2 eq.) or more (the “reporting threshold”) of the GHGs listed in Table 1 of Schedule 1 in the 2018 calendar year, is classified under the North American Industry Classification System (NAICS) codes listed in Table 2 of Schedule 3 and is engaged in any of the following:

- (i) mining,

- (ii) ethanol production,

- (iii) lime production,

- (iv) cement production,

- (v) aluminium production,

- (vi) iron and steel production,

- (vii) electricity and heat generation,

- (viii) ammonia production,

- (ix) nitric acid production,

- (x) hydrogen production,

- (xi) petroleum refineries,

- (xii) pulp and paper production, or

- (xiii) base metal production; or

- (c) a facility engaged in CO2 capture, CO2 transport, CO2 injection or CO2 storage in the 2018 calendar year.

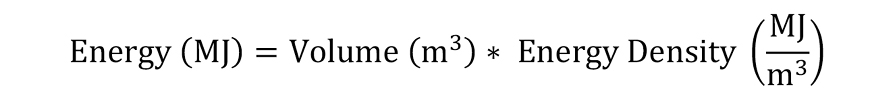

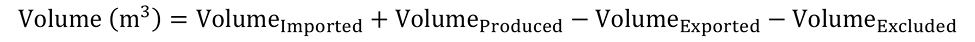

2. Any person who operates a facility described in this notice shall determine whether a facility meets or exceeds the reporting threshold using the following equation:

Where:

- E = total emissions of a particular gas or gas species in calendar year 2018, expressed in tonnes

- GWP = global warming potential of the particular gas or gas species, in Table 1 of Schedule 1

- i = each emission source

- (a) determine the quantity of CO2 eq. by multiplying the GWP of a particular GHG or GHG species listed in Table 1 of Schedule 1 by the quantity of a particular GHG or GHG species;

- (b) exclude CO2 emissions from the combustion of biomass in the determination of total emissions;

- (c) exclude CO2 emissions from biomass decomposition in the determination of total emissions.

3. Any person who operates a facility that is engaged in more than one activity described in paragraph 1(b) shall report emissions for each activity separately.

4. If the person who operates a facility described in section 1 changes during the 2018 calendar year, the facility operator on December 31, 2018, shall report for the entire 2018 calendar year. If facility operations terminate during the 2018 calendar year, the last facility operator shall report for the portion of the year during which the operations occurred.

Table 2: North American Industry Classification System (NAICS) codes under which facilities are subject to mandatory reporting

- 212

- 221112

- 221119

- 221330

- 322

- 324110

- 325120

- 325190

- 325313

- 327310

- 327410

- 331110

- 331313

- 331410

SCHEDULE 4

Reportable administrative information

1. Any person who operates a facility described in Schedule 3 of this notice shall, for each facility, report the

- (a) reporting company’s legal and trade name (if any) and federal business number (assigned by the Canada Revenue Agency) and its Dun and Bradstreet (D-U-N-S) number (if any);

- (b) facility name (if any) and the address of its physical location;

- (c) latitude and longitude coordinates of the facility, other than a pipeline transportation system and CO2 transport system;

- (d) six-digit North American Industry Classification System (NAICS) Canada code;

- (e) National Pollutant Release Inventory (NPRI) identification number (if any);

- (f) name, position, mailing and civic address, email address and telephone number of the person submitting the information that is required under this notice;

- (g) name, position, mailing address, email address and telephone number of the public contact (if any);

- (h) name, position, mailing and civic address, email address and telephone number of the authorized signing officer signing the Statement of Certification; and

- (i) legal names of the Canadian parent companies (if any), their civic addresses, their percentage of ownership of the reporting company (where available), their federal business number and their Dun and Bradstreet (D-U-N-S) number (if any).

2. The reported information required by this notice is to include a Statement of Certification, signed by an authorized signing officer, indicating that the information submitted is true, accurate and complete.

SCHEDULE 5

Reporting requirements

1. This schedule applies to any person who operates a facility described in paragraph 1(a) or 1(b) of Schedule 3 of this notice.

2. Any person subject to this schedule shall, for each of the GHGs listed in Table 1 of Schedule 1, report

- (a) the total quantity of CO2, CH4 and N2O emissions expressed in tonnes in each of the following source categories: stationary fuel combustion emissions, industrial process emissions, industrial product use emissions, venting emissions, flaring emissions, leakage emissions, on-site transportation emissions, waste emissions, and wastewater emissions listed in Table 3 of Schedule 5;

- (b) the total quantity of CH4 and N2O emissions expressed in tonnes from biomass combustion under stationary fuel combustion emissions if the biomass is being burned to produce energy, or under waste emissions in the case of waste incineration and landfill gas flaring processes;

- (c) the total quantity of CO2 emissions expressed in tonnes from biomass combustion; and

- (d) the total quantity of SF6 and each HFC and PFC emissions expressed in tonnes under industrial process emissions and industrial product use emissions.

3. Any person subject to this schedule shall

- (a) not account for CO2 emissions from biomass combustion in the total reported facility emissions;

- (b) not report CO2 emissions from biomass decomposition;

- (c) report emissions from coke oven batteries in iron and steel manufacturing under stationary fuel combustion (fuel use for the production of coke), flaring and/or leakage emissions; footnote 2 and

- (d) report emissions from hydrogen production as part of fossil fuel production and processing under venting emissions. footnote 3

4. Any person subject to this schedule, and to whom any of Schedules 6 through 18 of this notice apply, shall use the methods described in the applicable schedules to quantify the information that the person must report under this schedule. Where methods are not described in the applicable schedules for a specific emission source, methods described in section 5 shall be used.

5. Any person subject to this schedule, and to whom none of Schedules 6 through 18 of this notice apply, shall

- (a) use methods that are consistent with the 2006 Intergovernmental Panel on Climate Change (IPCC) Guidelines to quantify the information that the person reports under this schedule; and

- (b) report the methods used to determine the quantities reported under paragraphs 2(a), 2(b), 2(c) and 2(d) of this schedule, chosen from monitoring or direct measurement, mass balance, emission factors, or engineering estimates.

Emission Source Categories |

|||||||||

|---|---|---|---|---|---|---|---|---|---|

| Greenhouse Gas |

Stationary Fuel Combustion Emissions | Industrial Process Emissions | Industrial Product Use Emissions | Fugitive | On-site Transportation Emissions | Waste Emissions | Waste-water Emissions | ||

| Venting Emissions | Flaring Emissions | Leakage Emissions | |||||||

| Carbon dioxide (excluding CO2 emissions from biomass combustion, which is to be reported separately) | N/A | ||||||||

| Methane | N/A | ||||||||

| Nitrous oxide | N/A | ||||||||

| Sulphur hexafluoride | N/A | N/A | N/A | N/A | N/A | N/A | N/A | ||

| Hydrofluorocarbons | N/A | by species | by species | N/A | N/A | N/A | N/A | N/A | N/A |

| Perfluorocarbons | N/A | by species | by species | N/A | N/A | N/A | N/A | N/A | N/A |

| Total | |||||||||

SCHEDULE 6

CO2 capture, CO2 transport, CO2 injection and CO2 storage reporting requirements

1. This schedule applies to any person who operates a facility described in paragraph 1(c) of Schedule 3 of this notice.

2. Any person subject to this schedule shall use the quantification methods for carbon capture, transport and storage described in section 1 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity of CO2:

- (a) exiting each CO2 capture site, expressed in tonnes (t);

- (b) captured domestically within Canada, entering each CO2 transport system, expressed in tonnes (t);

- (c) imported from outside Canada, entering each CO2 transport system, expressed in tonnes (t);

- (d) exiting each CO2 transport system, expressed in tonnes (t);

- (e) entering each long-term geologic storage site, expressed in tonnes (t);

- (f) injected at each long-term geologic storage site, expressed in tonnes (t);

- (g) entering each enhanced fossil fuel recovery operation, expressed in tonnes (t); and

- (h) injected at each enhanced fossil fuel recovery operation, expressed in tonnes (t).

3. Any person subject to this schedule shall use section 1 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) annual mass of material transferred, expressed in tonnes (t), if using the mass flow method;

- (b) annual weighted average density of volumetric flow of material transferred with density expressed in kilograms per cubic metre (kg/mfootnote 3), temperature expressed in degrees Celsius (°C) and pressure expressed in kilopascals (kPa), if using the volumetric flow method;

- (c) annual weighted average CO2 concentration in the volumetric flow or mass flow, expressed as a mass fraction; and

- (d) method used to determine the quantities and parameters reported under section 2.

4. Any person subject to this schedule shall use section 1 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity, expressed in tonnes of CO2 fugitive emissions from equipment and infrastructure used for

- (a) CO2 capture;

- (b) CO2 transport;

- (c) CO2 injection at long-term geological storage site;

- (d) CO2 injection at enhanced fossil fuel recovery operations; and

- (e) method used to determine the quantities and parameters reported under paragraphs 4(a), (b), (c) and (d).

5. Any person subject to this schedule shall report the total annual quantity, expressed in tonnes, of CO2 surface leakage from each long-term geological storage site and enhanced fossil fuel recovery operation.

6. Any person subject to this schedule shall use section 1 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity, expressed in tonnes of CO2 venting emissions from equipment and infrastructure used for

- (a) CO2 capture;

- (b) CO2 transport;

- (c) CO2 injection at long-term geological storage site; and

- (d) CO2 injection at enhanced fossil fuel recovery operations.

SCHEDULE 7

Fuel combustion and flaring reporting requirements

1. This schedule applies to any person who operates a facility described in paragraph 1(b) of Schedule 3 of this notice.

2. Any person subject to this schedule and whose facility is classified under NAICS 221112 shall use section 2 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity, expressed in tonnes (t), of CO2, CH4 and N2O emissions, by fuel type and source, from

- (a) each electricity generating unit;

- (b) heat and steam generation;

- (c) all other stationary fuel combustion;

- (d) on-site transportation; and

- (e) flaring.

3. Any person subject to this schedule who is not subject to section 2 above shall use section 2 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity, expressed in tonnes (t), of CO2, CH4 and N2O emissions, by fuel type and source, from

- (a) electricity generation;

- (b) heat and steam generation;

- (c) all other stationary fuel combustion;

- (d) on-site transportation; and

- (e) flaring.

4. Any person subject to this schedule shall report the methods used to quantify each greenhouse gas under section 2 and section 3 of this schedule, by fuel type and source.

5. Any person subject to this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the total emissions by CO2, CH4 and N2O. The person shall report their fuel information by fuel type, in accordance with sections 6 and 7 below.

6. Any person subject to this schedule shall, for each fuel used under section 2 and section 3, report the

- (a) gaseous quantities, expressed in cubic metres (mfootnote 3) or in megajoules (MJ);

- (b) solid quantities, expressed in tonnes (t), for coal by rank and by country, province and state; and

- (c) liquid quantities, expressed in kilolitres (kl) or in megajoules (MJ).

7. Any person subject to this schedule shall, for each fuel used under section 2 and section 3, report the annual measured and weighted

- (a) higher heating value following Equation 2-26 in section 2 of Canada’s Greenhouse Gas Quantification Requirements, expressed in megajoules (MJ) higher heating value per unit of fuel consumed for all methods, except when applying Equation 2-2, Equation 2-4, Equation 2-11, Equation 2-19 or Equation 2-21;

- (b) carbon content following Equation 2-27 in section 2 of Canada’s Greenhouse Gas Quantification Requirements, expressed in kilograms of carbon per unit of fuel consumed, when using CEMS or the variable fuels or flaring methods (except when applying Equation 2-9, Equation 2-11, Equation 2-20 and for fuels identified in Table 2-3);

- (c) temperature, expressed in degrees Celsius (°C) and pressure, expressed in kilopascals (kPa), for gaseous quantities;

- (d) moisture content, expressed as a percentage (%), for solid quantities; and

- (e) CH4 and N2O emission factors, when using the facility-specific emission factors measured directly or provided by the fuel supplier or equipment manufacturers, expressed in grams per unit of fuel.

8. Any person subject to this schedule shall, for each fuel used under section 2 and section 3, report the default CO2, CH4 and N2O emission factors, when using values presented in Table 2-1 to Table 2-11 and in Equation 2-20, Equation 2-22 and Equation 2-23 of Canada’s Greenhouse Gas Quantification Requirements.

9. Any person subject to this schedule shall report, for each fuel, the combustion oxidation factor when applied and provide supporting documentation used in its derivation.

10. Any person subject to this schedule shall, for steam used to quantify emissions under section 2 and section 3 above, report the

- (a) steam quantities expressed in tonnes (t);

- (b) quantity and type of each biomass fuel combusted expressed in tonnes (t);

- (c) CO2, CH4 and N2O emission factors expressed in kilograms of CO2, CH4 and N2O/megajoules (MJ) of steam or kilograms of CO2, CH4 and N2O /tonnes (t) of steam; and

- (d) measured temperature, expressed in degrees Celsius (°C), the measured pressure expressed in kilopascals (kPa) and the ratio of the boiler’s design rated heat input capacity to its design rated steam output capacity, expressed in megajoules (MJ)/tonnes of steam, if using the steam default emission factor method.

11. Any person subject to this schedule and whose facility is classified under NAICS 221112 shall report the annual quantities of

- (a) gross electricity generated on-site by each electricity generating unit, expressed in megawatt hours (MWh);

- (b) electricity sold off-site, expressed in megawatt hours (MWh);

- (c) electricity lost on-site, expressed in megawatt hours (MWh); and

- (d) electricity purchased, expressed in megawatt hours (MWh).

12. Any person subject to this schedule who is not subject to section 2 above shall report the annual quantities of

- (a) gross electricity generated on-site, expressed in megawatt hours (MWh);

- (b) electricity sold off-site, expressed in megawatt hours (MWh);

- (c) electricity lost on-site, expressed in megawatt hours (MWh); and

- (d) electricity purchased, expressed in megawatt hours (MWh).

13. Any person subject to this schedule shall, for heat and steam generation, report the annual quantities of

- (a) gross steam and heat generated on-site, expressed in megajoules (MJ);

- (b) gross steam and heat used to generate electricity on-site, expressed in megajoules (MJ);

- (c) steam and heat sold off-site, expressed in megajoules (MJ);

- (d) steam and heat purchased, expressed in megajoules (MJ); and

- (e) steam or heat lost on-site, expressed in megajoules (MJ).

14. Any person subject to section 11, section 12 and section 13 of this schedule shall use methods conforming to the Weights and Measures Act to measure the reported annual quantities purchased and sold.

15. Any person subject to this schedule shall submit documentation describing the methodology used, when

- (a) developing equipment-specific on-site transportation emission factors, as directed in section 2.A.1a(3) or 2.B(3)(B) of Canada’s Greenhouse Gas Quantification Requirements;

- (b) determining the mass of biomass combusted for premixed fuels containing biomass and fossil fuels, as directed in section 2.A.4 of Canada’s Greenhouse Gas Quantification Requirements; or

- (c) developing facility-specific CH4 and N2O emission factors, as directed in section 2.B(1) of Canada’s Greenhouse Gas Quantification Requirements.

16. Any person subject to this schedule, who obtains from a supplier or performs fuel sampling, analysis and consumption measurement, as outlined in section 2.D of Canada’s Greenhouse Gas Quantification Requirements, shall submit a fuel quantity, carbon content and higher heating value for all sampling and measurement periods.

17. Any person subject to this schedule is not required to report fuels and their associated emissions when the sum of CO2, CH4 and N2O emissions (excluding CO2 from biomass), in CO2 eq., from the combustion of one or more of these fuels does not exceed 0.5% of the total facility GHG emissions from all fuels combusted (excluding CO2 from biomass combustion).

SCHEDULE 8

Lime production reporting requirements

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(iii) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice. For lime kilns at pulp and paper facilities, the person shall report using Schedule 17 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 3 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from lime production, expressed in tonnes (t);

- (b) total monthly quantity of lime, by lime type, expressed in tonnes (t);

- (c) monthly plant-specific emission factor, by lime type, expressed in tonnes of CO2/tonnes of lime;

- (d) monthly calcium oxide (CaO) content of lime, by lime type, expressed in tonnes of CaO/tonnes of lime;

- (e) monthly magnesium oxide (MgO) content of lime, by lime type, expressed in tonnes of MgO/tonnes of lime;

- (f) total quarterly quantity of calcined by-products/wastes, by by-product/waste type, expressed in tonnes (t);

- (g) quarterly plant-specific emission factor of calcined by-products/wastes, by calcined by-product/waste type, expressed in tonnes of CO2/tonnes of by-product/waste;

- (h) quarterly weighted average calcium oxide (CaO) content of calcined by-products/wastes, by calcined by-product/waste type, expressed in tonnes of CaO/tonnes of by-product/waste; and

- (i) quarterly weighted average magnesium oxide (MgO) content of calcined by-products/wastes, by calcined by-product/waste type, expressed in tonnes of MgO/ tonnes of by-product/waste.

3. Any person described in this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the emissions and production quantities under paragraphs 2(a), (b), and (f). This shall not include the emissions information specified for CEMS in Schedule 7 of this notice. The person shall indicate where CEMS is being used to calculate emissions.

SCHEDULE 9

Cement production reporting requirements

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(iv) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 4 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from clinker production, expressed in tonnes (t);

- (b) total monthly quantity of clinker, expressed in tonnes (t);

- (c) monthly plant-specific emission factor of clinker, expressed in tonnes of CO2/tonnes of clinker;

- (d) monthly calcium oxide (CaO) content of clinker, expressed in tonnes of CaO/tonnes of clinker;

- (e) monthly magnesium oxide (MgO) content of clinker, expressed in tonnes of MgO/tonnes of clinker;

- (f) monthly non-calcined calcium oxide (CaO) content of clinker, expressed in tonnes of CaO/tonnes of clinker;

- (g) monthly non-calcined magnesium oxide (MgO) content of clinker, expressed in tonnes of MgO/tonnes of clinker;

- (h) monthly quantity of non-carbonate raw materials entering the kiln, expressed in tonnes (t);

- (i) total annual quantity of CO2 emissions from organic carbon oxidation, expressed in tonnes (t);

- (j) total annual quantity of raw material consumption, expressed in tonnes (t);

- (k) annual weighted average carbon content in raw material consumption, expressed in tonnes of C/tonnes of raw material consumption;

- (l) total annual quantity of CO2 emissions from cement kiln dust (CKD) not recycled back to the kiln, expressed in tonnes (t);

- (m) total quarterly quantity of CKD not recycled back to the kiln, expressed in tonnes (t);

- (n) quarterly plant-specific emission factor of CKD not recycled back to the kiln, expressed in tonnes of CO2/tonnes of CKD.

- (o) quarterly calcium oxide (CaO) content of CKD not recycled back to the kiln, expressed in tonnes of CaO/tonnes of CKD;

- (p) quarterly magnesium oxide (MgO) content of CKD not recycled back to the kiln, expressed in tonnes of MgO/tonnes of CKD;

- (q) quarterly non-calcined calcium oxide (CaO) content of CKD not recycled back to the kiln, expressed in tonnes of CaO/tonnes of CKD; and

- (r) quarterly non-calcined magnesium oxide (MgO) content of CKD not recycled back to the kiln, expressed in tonnes of MgO/tonnes of CKD.

3. Any person subject to this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the emissions and production information under paragraphs 2(a), (b), (h), (i), (l) and (m). This shall not include the emissions information specified for CEMS in Schedule 7 of this notice. The person shall indicate where CEMS is being used to calculate emissions.

SCHEDULE 10

Aluminium production reporting requirements

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(v) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.1 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from prebaked anode consumption, expressed in tonnes (t);

- (b) annual anode consumption, expressed in tonnes of anodes/tonnes of liquid aluminium production;

- (c) annual sulphur content of prebaked anodes, expressed in kilograms of S/kilograms of prebaked anodes; and

- (d) annual ash content of prebaked anodes, expressed in kilograms of ash/kilograms of prebaked anodes.

3. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.2 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from anode consumption from Søderberg electrolysis cells, expressed in tonnes (t);

- (b) total annual quantity of CSM emissions, expressed in tonnes, or the International Aluminium Institute factor used, expressed in kilograms of CSM/tonnes of liquid aluminium;

- (c) total annual anode paste consumption, expressed in tonnes of paste/tonnes of liquid aluminium;

- (d) annual average content of pitch or other binding agent in paste, expressed in kilograms of pitch or other binding agent/kilograms of paste;

- (e) annual sulphur content in pitch or other binding agent, expressed in kilograms of S/kilograms of pitch or other binding agent;

- (f) annual ash content in pitch or other binding agent, expressed in kilograms of ash/kilograms of pitch or other binding agent;

- (g) annual hydrogen content in pitch or other binding agent, expressed in kilograms of H2/kilograms of pitch or other binding agent, or the International Aluminium Institute factor used;

- (h) annual sulphur content in calcinated coke, expressed in kilograms of S/kilograms of calcinated coke;

- (i) annual ash content in calcinated coke, expressed in kilograms of ash/kilograms of calcinated coke; and

- (j) annual carbon content in dust from Søderberg electrolysis cells, expressed in kilograms of C/kilograms of liquid aluminium, or a value of 0.

4. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.3 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity of CO2 emissions from anode and cathode baking, expressed in tonnes (t).

5. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.4 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from packing material consumption, expressed in tonnes (t);

- (b) annual packing material consumption, expressed in tonnes of packing material/tonnes of baked anodes or cathodes;

- (c) total annual quantity of baked anodes and cathodes removed from furnace, expressed in tonnes (t);

- (d) annual weighted average ash content of packing material, expressed in kilograms of ash/kilograms of packing material; and

- (e) annual weighted average sulphur content of packing material, expressed in kilograms of S/kilograms of packing material.

6. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.5 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from coking of pitch or other binding agent, expressed in tonnes (t);

- (b) total annual quantity of green anodes or cathodes put into furnace, expressed in tonnes (t);

- (c) total annual quantity of baked anodes or cathodes removed from furnace, expressed in tonnes (t);

- (d) annual weighted average hydrogen content of pitch or other binding agent, or the International Aluminium Institute factor used, expressed in kilograms of H2/kilograms of pitch or other binding agent;

- (e) annual weighted average pitch content of green anodes or cathodes, expressed in kilograms of pitch or other binding agent/kilograms of anodes or cathodes; and

- (f) total annual quantity of recovered tar, expressed in tonnes (t).

7. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.6 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from green coke calcination, expressed in tonnes (t);

- (b) total annual quantity of CO2 emissions from coke dust, expressed in tonnes (t);

- (c) total annual quantity of green coke consumption, expressed in tonnes (t);

- (d) total annual quantity of calcinated coke production, expressed in tonnes (t);

- (e) total annual quantity of under-calcinated coke production, expressed in tonnes (t);

- (f) annual water content in green coke, expressed in kilograms of H2O/kilograms of green coke;

- (g) annual volatile materials content in green coke, expressed in kilograms of volatile materials/kilograms of green coke;

- (h) annual sulphur content in green coke, expressed in kilograms of S/kilograms of green coke; and

- (i) annual sulphur content in calcinated coke, expressed in kilograms of S/kilograms of calcinated coke.

8. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.7 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CF4 emissions from anode effects, expressed in tonnes (t);

- (b) annual slope, if using the slope method, by a series of pots, expressed in tonnes of CF4/tonnes of liquid aluminium/anode effect minute/pot-day/year;

- (c) annual anode effect duration, if using the slope method, expressed in anode effect minutes/pot-day calculated per year and obtained by multiplying the anode effects frequency, in number of anode effects per pot-day, by the average duration of anode effects in minutes;

- (d) overvoltage coefficient, if using the overvoltage coefficient method, expressed in tonnes of CF4/tonnes of liquid aluminium/millivolt;

- (e) annual anode effect overvoltages, if using the overvoltage coefficient method, expressed in millivolts/pot;

- (f) current efficiency of the aluminium production process, if using the overvoltage coefficient method, expressed as a fraction; and

- (g) method used to determine the quantities reported under paragraph (a).

9. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.7 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of C2F6 emissions, expressed in tonnes (t); and

- (b) weight fraction of C2F6 to CF4 or selected from Table 5-2, expressed in kilograms of C2F6/kilograms of CF4.

10. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 5.A.8 of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity of emissions from SF6 used as a cover gas, expressed in tonnes (t).

11. Any person subject to this schedule shall report the total annual quantity of liquid aluminium production, expressed in tonnes (t).

12. Any person subject to this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the emissions under sections 2 to 7 of this schedule. This shall not include the emissions information specified for CEMS in Schedule 7 of this notice. The person shall indicate where CEMS is being used to calculate emissions.

SCHEDULE 11

Iron and steel production reporting requirements

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(vi) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall report the

- (a) total annual quantity of biomass consumed, by biomass type, expressed in tonnes (t); and

- (b) type of use for biomass (such as flux material, reducing agent).

3. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.1 of Canada’s Greenhouse Gas Quantification Requirements for an induration furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of green pellets consumption, expressed in tonnes, if using equation 6-1;

- (c) annual weighted average carbon content of green pellets consumption, expressed in tonnes of C/tonnes of green pellets, if using equation 6-1;

- (d) total annual quantity of additive material consumption, by material type, expressed in tonnes, if using equation 6-2;

- (e) annual weighted average carbon content of additive material consumption, expressed in tonnes of C/tonnes of additive material, if using equation 6-2;

- (f) total annual quantity of iron ore concentrate fed to the furnace, expressed in tonnes, if using equation 6-2;

- (g) annual weighted average carbon content of iron ore concentrate fed to the furnace, expressed in tonnes of C/tonnes of iron ore concentrate;

- (h) total annual quantity of fired pellet production, expressed in tonnes (t);

- (i) annual weighted average carbon content of fired pellet production, expressed in tonnes of C/tonnes of fired pellets;

- (j) annual quantity of air pollution control residue collected, expressed in tonnes (t);

- (k) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue; and

- (l) method used to determine the quantities under paragraph (a) above.

4. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.2 of Canada’s Greenhouse Gas Quantification Requirements for a basic oxygen furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of molten iron charged to the furnace, expressed in tonnes (t);

- (c) annual weighted average carbon content of molten iron charged to the furnace, expressed in tonnes of C/tonnes of molten iron;

- (d) total annual quantity of ferrous scrap charged to the furnace, expressed in tonnes (t);

- (e) annual weighted average carbon content of ferrous scrap charged to the furnace, expressed in tonnes of C/tonnes of ferrous scrap;

- (f) total annual quantity of carbonaceous material consumption, by material type, expressed in tonnes (t);

- (g) annual weighted average carbon content of non-biomass carbonaceous material consumption, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (h) total annual quantity of non-biomass flux material charged to the furnace, by material type, expressed in tonnes (t);

- (i) annual weighted average carbon content of non-biomass flux material charged to the furnace, expressed in tonnes of C/tonnes of flux;

- (j) total annual quantity of molten raw steel production, expressed in tonnes (t);

- (k) annual weighted average carbon content of molten raw steel production, expressed in tonnes of C/tonnes of molten raw steel;

- (l) total annual quantity of slag production, expressed in tonnes (t);

- (m) annual weighted average carbon content of slag production, expressed in tonnes of C/tonnes of slag;

- (n) total annual quantity of furnace gas transferred off-site, expressed in tonnes (t);

- (o) annual weighted average carbon content of furnace gas transferred off-site, expressed in tonnes of C/tonnes of furnace gas transferred;

- (p) total annual quantity of air pollution control residue collected, expressed in tonnes (t); and

- (q) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

5. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.3 of Canada’s Greenhouse Gas Quantification Requirements for coke oven battery to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of coking coal charged to battery, expressed in tonnes (t);

- (c) annual weighted average carbon content of non-biomass coking coal charged to battery, expressed in tonnes of C/tonnes of coking coal;

- (d) total annual quantity of non-biomass carbonaceous material consumption, other than coking coal charged to battery, by material type, expressed in tonnes (t);

- (e) annual weighted average carbon content of non-biomass carbonaceous material consumption, other than coking coal charged to battery, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (f) total annual quantity of coke produced, expressed in tonnes (t);

- (g) annual weighted average carbon content of coke produced, expressed in tonnes of C/tonnes of coke;

- (h) total annual quantity of coke oven gas transferred off-site, expressed in tonnes (t);

- (i) annual weighted average carbon content of coke oven gas transferred off-site, expressed in tonnes of C/tonnes of coke oven gas;

- (j) total annual quantity of by-product from coke oven battery, expressed in tonnes (t);

- (k) annual weighted average carbon content of non-biomass by-product from coke oven battery, expressed in tonnes of C/tonnes of by-product;

- (l) total annual quantity of air pollution control residue collected, expressed in tonnes (t); and

- (m) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

6. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.4 of Canada’s Greenhouse Gas Quantification Requirements for sinter production to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of non-biomass carbonaceous material consumption, by material type, expressed in tonnes (t);

- (c) annual weighted average carbon content of non-biomass carbonaceous material consumption, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (d) total annual quantity of sinter feed material, expressed in tonnes (t);

- (e) annual weighted average carbon content of sinter feed material, expressed in tonnes of C/tonnes of sinter feed;

- (f) total annual quantity of sinter production, expressed in tonnes (t);

- (g) annual weighted average carbon content of sinter production, expressed in tonnes of C/tonnes of sinter production;

- (h) total annual quantity air pollution control residue collected, expressed in tonnes (t); and

- (i) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

7. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.5 of Canada’s Greenhouse Gas Quantification Requirements for an electric arc furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of direct reduced iron charged to furnace, expressed in tonnes (t);

- (c) annual weighted average carbon content of direct reduced iron charged to furnace, expressed in tonnes of C/tonnes of direct reduced iron;

- (d) total annual quantity of ferrous scrap charged to furnace, expressed in tonnes (t);

- (e) annual weighted average carbon content of ferrous scrap charged to furnace, expressed in tonnes of C/tonnes of ferrous scrap;

- (f) total annual quantity of carbonaceous material consumption, by material type, expressed in tonnes (t);

- (g) annual weighted average carbon content of non-biomass carbonaceous material consumption, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (h) total annual quantity of carbon electrode consumption, expressed in tonnes (t);

- (i) annual weighted average carbon content of non-biomass carbon electrode consumption, expressed in tonnes of C/tonnes of carbon electrode;

- (j) total annual quantity of flux material charged to the furnace, by material type, expressed in tonnes (t);

- (k) annual weighted average carbon content of non-biomass flux material charged to the furnace, expressed in tonnes of C/tonnes of flux;

- (l) total annual quantity of molten raw steel production, expressed in tonnes (t);

- (m) annual weighted average carbon content of molten raw steel production, expressed in tonnes of C/tonnes of molten raw steel;

- (n) total annual quantity of slag production, expressed in tonnes (t);

- (o) annual weighted average carbon content of slag production, expressed in tonnes of C/tonnes of slag;

- (p) total annual quantity air pollution control residue collected, expressed in tonnes (t); and

- (q) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

8. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.6 of Canada’s Greenhouse Gas Quantification Requirements for an argon-oxygen decarburization vessel to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of molten steel charged to the vessel, expressed in tonnes (t);

- (c) annual weighted average carbon content of molten steel charged to the vessel, expressed in tonnes of C/tonnes of molten raw steel;

- (d) annual weighted average carbon content of molten steel before decarburization, expressed in tonnes of C/tonnes of molten steel;

- (e) annual weighted average carbon content of molten steel after decarburization, expressed in tonnes of C/tonnes of molten steel;

- (f) total annual quantity of air pollution control residue collected, expressed in tonnes (t); and

- (g) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

9. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.7 of Canada’s Greenhouse Gas Quantification Requirements for a direct reduction furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of iron ore or iron ore pellets consumption, expressed in tonnes (t);

- (c) annual weighted average carbon content of iron ore or iron ore pellets consumption, expressed in tonnes of C/tonnes of iron ore or iron ore pellets;

- (d) total annual quantity of consumed raw material, other than carbonaceous material and ore, by material type, expressed in tonnes (t);

- (e) annual weighted average carbon content of raw material, other than carbonaceous material and ore, by material type, expressed in tonnes of C/tonnes of raw material;

- (f) total annual quantity of carbonaceous material consumption, by material type, expressed in tonnes (t);

- (g) annual weighted average carbon content of non-biomass carbonaceous material consumption, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (h) total annual quantity of iron production, expressed in tonnes (t);

- (i) annual weighted average carbon content of iron production, expressed in tonnes of C/tonnes of iron;

- (j) total annual quantity of non-metallic material production, expressed in tonnes (t);

- (k) annual weighted average carbon content of non-metallic material production, expressed in tonnes of C/tonnes of non-metallic material;

- (l) total annual quantity of air pollution control residue collected, expressed in tonnes (t); and

- (m) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

10. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.8 of Canada’s Greenhouse Gas Quantification Requirements for a blast furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of iron ore or iron ore pellets consumption, expressed in tonnes (t);

- (c) annual weighted average carbon content of iron ore or iron ore pellets consumption, expressed in tonnes of C/tonnes of iron ore or iron ore pellets;

- (d) total annual quantity of consumed raw material, other than carbonaceous material and ore, by material type, expressed in tonnes (t);

- (e) annual average carbon content of consumed raw material, other than carbonaceous material and ore, by material type, expressed in tonnes of C/tonnes of raw material;

- (f) total annual quantity of carbonaceous material consumption, by material type, expressed in tonnes (t);

- (g) annual weighted average carbon content of non-biomass carbonaceous material consumption, by material type, expressed in tonnes of C/tonnes of carbonaceous material;

- (h) total annual quantity of flux material charged to the furnace, by material type, expressed in tonnes (t);

- (i) annual weighted average carbon content of non-biomass flux material charged to the furnace, expressed in tonnes of C/tonnes of flux;

- (j) total annual quantity of iron production, expressed in tonnes (t);

- (k) annual weighted average carbon content of iron production, expressed in tonnes of C/tonnes of iron;

- (l) total annual quantity of non-metallic material production, expressed in tonnes (t);

- (m) annual weighted average carbon content of non-metallic material production, expressed in tonnes of C/tonnes of non-metallic material;

- (n) total annual quantity of blast furnace gas transferred off-site, expressed in tonnes (t);

- (o) annual weighted average carbon content of blast furnace gas transferred off-site, expressed in tonnes of C/tonnes of blast furnace gas;

- (p) total annual quantity of air pollution control residue collected, expressed in tonnes (t); and

- (q) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue.

11. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.A.9 of Canada’s Greenhouse Gas Quantification Requirements for the ladle furnace to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of molten steel fed to the furnace, expressed in tonnes (t);

- (c) annual weighted average carbon content of molten steel fed to the furnace, expressed in tonnes of C/tonnes of molten steel;

- (d) total annual quantity of additive material consumed by the furnace, by material type, expressed in tonnes (t);

- (e) annual weighted average carbon content of additive material consumed by the furnace, by material type, expressed in tonnes of C/tonnes of additive material;

- (f) total annual carbon electrodes consumed by the furnace, expressed in tonnes (t);

- (g) annual weighted average carbon content of carbon electrodes consumed by the furnace, expressed in tonnes of C/tonnes of carbon electrodes;

- (h) total annual quantity of molten steel production, expressed in tonnes (t);

- (i) annual weighted average carbon content of molten steel production, expressed in tonnes of C/tonnes of molten steel;

- (j) total annual quantity of slag production, expressed in tonnes (t);

- (k) annual weighted average carbon content of slag production, or a default value of 0, expressed in tonnes of C/tonnes of slag;

- (l) total annual quantity of air pollution control residue collected, expressed in tonnes (t);

- (m) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue;

- (n) total annual quantity of other residue produced, expressed in tonnes (t); and

- (o) annual weighted average carbon content of other residue produced or a default value of 0, expressed in tonnes of C/tonnes of residue.

12. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.B.1 of Canada’s Greenhouse Gas Quantification Requirements for the atomization of molten cast iron to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of molten cast iron fed into the process, expressed in tonnes (t);

- (c) annual weighted average carbon content of molten cast iron fed into the process, expressed in tonnes of C/tonnes of molten cast iron;

- (d) total annual quantity of other material used in the process, by material type, expressed in tonnes (t);

- (e) annual weighted average carbon content of other material used in the process, by material type, expressed in tonnes of C/tonnes of other material;

- (f) total annual quantity of atomized cast iron production, expressed in tonnes (t);

- (g) annual weighted average carbon content of atomized cast iron production, expressed in tonnes of C/tonnes of atomized cast iron;

- (h) total annual quantity of by-products, by by-product type, expressed in tonnes (t); and

- (i) annual weighted average carbon content of by-products, reported by by-product type, expressed in tonnes of C/tonnes of by-product.

13. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.B.2 of Canada’s Greenhouse Gas Quantification Requirements for the decarburization of iron powder to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of iron powder fed into the process, expressed in tonnes (t);

- (c) annual weighted average carbon content of iron powder fed into the process, expressed in tonnes of C/tonnes of iron powder;

- (d) total annual quantity of decarburized iron powder production, expressed in tonnes (t);

- (e) annual weighted average carbon content of decarburized iron powder production, expressed in tonnes of C/tonnes of decarburized iron powder production;

- (f) total annual quantity of by-product, by by-product type, expressed in tonnes (t); and

- (g) annual weighted average carbon content of by-product, by by-product type, expressed in tonnes of C/tonnes of by-product.

14. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.B.3 of Canada’s Greenhouse Gas Quantification Requirements for steel grading to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of molten steel fed into the process, expressed in tonnes (t);

- (c) annual weighted average carbon content of molten steel fed into the process, expressed in tonnes of C/tonnes of molten steel;

- (d) total annual quantity of additive used in the process, expressed in tonnes (t);

- (e) annual weighted average carbon content of additive used in the process, by additive type, expressed in tonnes of C/tonnes of additive;

- (f) total annual quantity of carbon electrode consumption, expressed in tonnes (t);

- (g) annual weighted average carbon content of carbon electrode consumption, expressed in tonnes of C/tonnes of carbon electrode consumption;

- (h) total annual quantity of molten steel production, expressed in tonnes (t);

- (i) annual weighted average carbon content of molten steel production, expressed in tonnes of C/tonnes of molten steel production;

- (j) total annual quantity of slag production, expressed in tonnes (t);

- (k) annual weighted average carbon content of slag production, expressed in tonnes of C/tonnes of slag production;

- (l) total annual quantity of air pollution control residue collected, expressed in tonnes (t);

- (m) annual weighted average carbon content of air pollution control residue collected, expressed in tonnes of C/tonnes of residue;

- (n) total annual quantity of other residue production, expressed in tonnes (t); and

- (o) annual weighted average carbon content of other residue production, expressed in tonnes of C/tonnes of other residue.

15. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 6.B.4 of Canada’s Greenhouse Gas Quantification Requirements for steel powder annealing to report the

- (a) total annual quantity of CO2 emissions, expressed in tonnes (t);

- (b) total annual quantity of steel powder fed into the process, expressed in tonnes (t);

- (c) annual weighted average carbon content of steel powder fed into the process, expressed in tonnes of C/tonnes of steel powder;

- (d) total annual quantity of steel powder production, expressed in tonnes (t);

- (e) annual weighted average carbon content of steel powder production, expressed in tonnes of C/tonnes of steel powder;

- (f) total annual quantity of by-product, by by-product type, expressed in tonnes (t); and

- (g) annual weighted average carbon content of by-product, by by-product type, expressed in tonnes of C/tonnes of by-product.

16. Any person subject to this schedule who operates a facility with stacks monitored by CEMS shall use the greenhouse gas quantification methods in section 6.A of Canada’s Greenhouse Gas Quantification Requirements for iron and steel production to report

- (a) CO2 emissions information under sections 3 to 15 of this schedule separately from CO2 emissions information specified for CEMS in Schedule 7 of this notice; and

- (b) production information specified under paragraphs 3(h), 4(j), 4(l), 5(d), 6(f), 7(l), 7(n), 8(b), 9(h), 9(j), 10(j), 10(l), 11(h), 11(j), 12(f), 13(d), 14(h), 14(j) and 15(d).

SCHEDULE 12

Electricity and heat generation

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(vii) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 7 of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of CO2 emissions from acid gas scrubbing, expressed in tonnes (t); and

- (b) total annual consumption of limestone or other sorbent, by sorbent type, expressed in tonnes (t).

SCHEDULE 13

Ammonia production

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(viii) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 8.A of Canada’s Greenhouse Gas Quantification Requirements to report the total annual quantity of feedstock consumption, by feedstock type, expressed in

- (a) cubic metres (mfootnote 3), for gaseous quantities;

- (b) kilolitres (kl), for liquid quantities; and

- (c) tonnes (t), for solid quantities.

3. Any person subject to this schedule shall, for each feedstock type used under section 3, report the annual weighted average carbon content expressed in

- (a) kilograms (kg) of C/kilograms (kg) of feedstock, for gaseous quantities;

- (b) kilograms (kg) of C/kilolitres (kl) of feedstock, for liquid quantities; and

- (c) kilograms (kg) of C/kilograms (kg) of feedstock, for solid quantities.

4. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 8.A of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of urea, expressed in tonnes (t);

- (b) total annual quantity of ammonia, expressed in tonnes (t);

- (c) total annual quantity of CO2 emissions from ammonia production, expressed in tonnes (t); and

- (d) total annual quantity of CO2 consumed in urea production, expressed in tonnes (t).

5. Any person subject to this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the emissions under paragraph 4(c). This shall not include the emissions information specified for CEMS in Schedule 7 of this notice. The person shall indicate where CEMS is being used to calculate emissions.

SCHEDULE 14

Nitric acid production

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(ix) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 9.A of Canada’s Greenhouse Gas Quantification Requirements to report the

- (a) total annual quantity of N2O emissions, expressed in tonnes (t); and

- (b) total annual quantity of nitric acid produced, expressed in tonnes (t).

3. Any person subject to this schedule who operates a facility where there is abatement downtime shall report the

- (a) annual weighted average N2O emission factor, expressed in kilograms (kg) of N2O/tonnes (t) of nitric acid, 100% acid base;

- (b) annual weighted average abatement factor of N2O abatement technology per acid train, expressed as a fraction of annual nitric acid production per train in which abatement technology is operating; and

- (c) destruction efficiency of N2O abatement technology used on nitric acid train, expressed as percent of N2O removed from air stream, by type of abatement technology. Documentation demonstrating how process knowledge was used to estimate destruction efficiency shall be provided, if not specified by the manufacturer or estimated using Equation 9-3 of Canada’s Greenhouse Gas Quantification Requirements.

4. Any person subject to this schedule who operates a facility where the NOx abatement is integrated within the operating process and cannot be bypassed shall report the annual weighted average N2O emission factor, expressed in kilograms (kg) of N2O/tonnes (t) of nitric acid, 100% acid base.

5. Any person subject to this schedule who operates a facility with stacks monitored by CEMS may use the annual emissions data from CEMS to report the emissions under paragraph 2(a). The person shall indicate where CEMS is being used to calculate emissions.

SCHEDULE 15

Hydrogen production

1. This schedule applies to any person who operates a facility described in subparagraph 1(b)(x) of Schedule 3 of this notice. For fuel combustion and flaring emissions, the person shall report using Schedule 7 of this notice. For ammonia production, the person shall report using Schedule 13 of this notice.

2. Any person subject to this schedule shall use the greenhouse gas quantification methods in section 10.A of Canada’s Greenhouse Gas Quantification Requirements to report the